In biotechnology we’ve seen poor business models, incompetent management teams, stock promoters, flawed technologies and bad science. And then we found Mountain Valley MD (CSE:MVMD), one of the worst companies we have ever conducted diligence on, an exceptionally flawed specimen exhibiting all of these qualities with flair.

The purported developer of drug delivery technologies is led by a former salesman and consultant with no evidence of scientific or pharmaceutical experience, and a chief scientist whose prior work is in failed dietary supplements and testosterone boosters. Undaunted, MVMD has pivoted from cannabis, to nutraceuticals, to pharmaceuticals, to COVID – all within less than a year.

Shares are up 2000% in the last three months fueled by a flurry of puffed-up press releases, paid stock promotion and slick marketing videos offering nothing more than inspirational cliches. Drug delivery is an important field, advancements in which can improve outcomes for patients and provide value for shareholders – but MVMD with a staff of non-scientists and a banal liposome technology will not be involved.

We examine MVMD’s scientific claims with two leading experts in the drug delivery space, both of whom find serious concerns which we publish in this report. Mountain Valley trades at C$500m enterprise value but based on our work we believe shares will prove worthless. We discuss the following:

- Mountain Valley has pivoted from one hype-filled sector to another – we believe its COVID effort will follow the same disastrous outcome as its failed cannabis endeavor

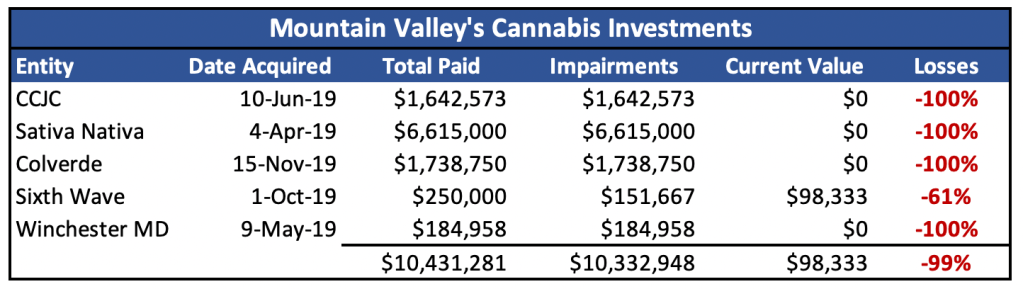

- MVMD’s most tangible progress in cannabis was a series of investments that were written off completely resulting in cumulative losses of over $10m

- MVMD’s lead scientist has peddled the same delivery technology for years across multiple product formats without success. MVMD claims the same technology can revolutionize medicine.

- We find no evidence of MVMD’s lead scientist completing scientific training or a science-based degree (or any degree); no employees have pharmaceutical related experience

- Management touts a TAM in the tens of billions, yet recently signed a tiny $250k licensing agreement with an obscure mushroom counterparty

- The Chief Medical Officer of this mushroom company was forced to resign from taxpayer-funded clinic after an audit revealed he embezzled over $2m

- MVMD recently halted its stock overnight to announce animal trials and a partner in Bangladesh. We reveal the partner is primarily a garment manufacturer located in same building as an elementary school (we have photos)

- MVMD’s prolific stock promotion includes dozens of ads portrayed as unbiased interviews with known stock promoters

- We interview two drug delivery experts – both extremely skeptical of MVMD and “struggle to see any value”

- MVMD has only completed one pre-clinical study – in canines. Our experts are baffled Mountain Valley would hype the results, calling them vague and unremarkable

- MVMD claims its products are “unprecedented”, yet it owns only two relevant patents (with the same title) of questionable value

- MVMD’s flagship product candidate is a modified form of the generic anti-parasitic drug ivermectin as a treatment for COVID. Ivermectin is not approved for COVID in most of the world, its trial data criticized by most of the medical community including National Institutes of Health, Infectious Disease Society of America and Merck

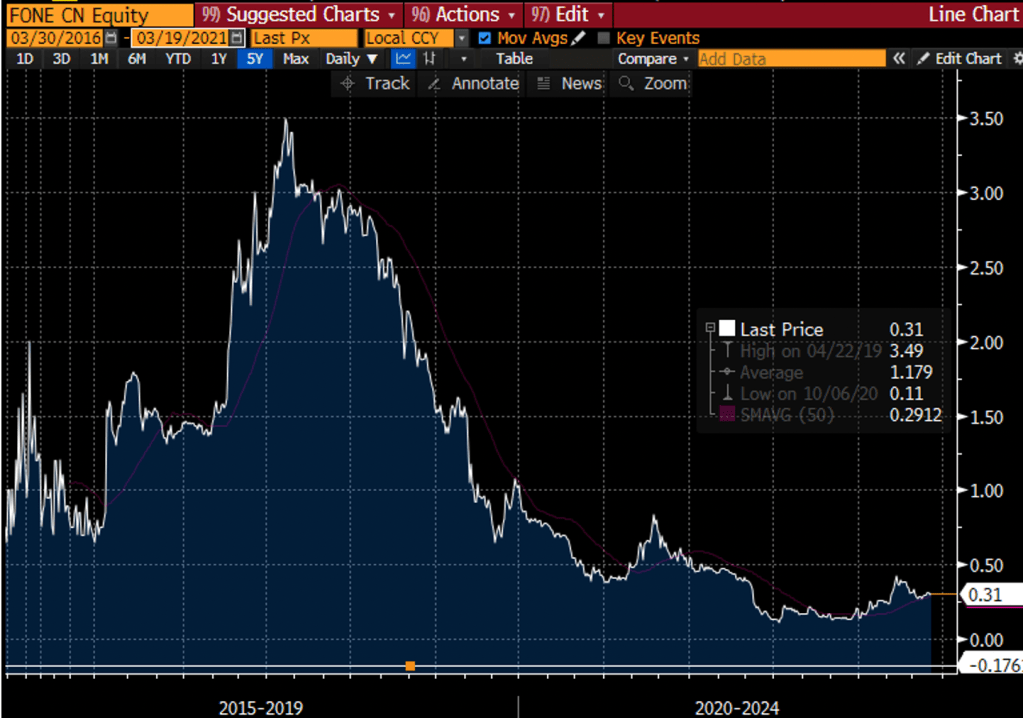

- Prior CFO founded a cannabis company whose stock declined 80% since IPO and just received a notice of default from debt holders

- Three months ago, MVMD raised cash at 80% below current levels with warrants. The stock is up 6x since despite no meaningful news

- MVMD quietly equitized $0.5m of debt at $0.07c/unit on the same day it announced an equity financing at $0.22/unit. Neither the debt nor the counterparty was disclosed

As an example of Mountain Valley’s unique promotional style, we highlight the below video:

Exhibit 1. Mountain Valley marketing video

Source: YouTube

“At times our reach exceeds our grasp. We clasp our hands together in hope that the world will not always be this way. We reach for tomorrow so that the ravages of our now may be laid to rest in our yesterday so that knowledge can lead the way to a world without COVID, malaria, polio. We reach so that one day we may know the answers we don’t already. We reach for freedom from disease, doubt and fear. We reach past our potential. We reach for what we don’t already know so that one day our reach can finally grasp tomorrow. We reach because impossible isn’t…” – Mountain Valley MD mission page

Prelude: Mountain Valley Halts Stock Overnight to Announce Trials… In Animals… In Bangladesh

On March 16, MVMD announced it was starting trials of its own solubilized form of the anti-parasitic generic drug ivermectin in husbandry animals in Bangladesh. It’s unclear what unmet need MVMD is trying to fill – current forms of the drug have been in use for decades.

Mountain Valley mentioned a partner in Bangladesh, R&G Group (located here), which is facilitating its work in the country in areas such as research and development and manufacturing. Since R&G seems to be primarily involved in garment manufacturing, call centers and an event management business called Interactive Showbiz, it’s unclear how they can help. We have attempted to contact R&G CEO Saifur Rashid to learn more, thus far unsuccessfully.

For this the company halted its stock midday until the next morning.

Exhibit 2. Mountain Valley partner office in Dhaka. R&G is primarily a textile business

Source: Google Maps

Background: Multiple Dubious Pivots

Mountain Valley MD is a Canadian developer of drug delivery technologies theorized to improve the efficacy of existing supplements, drugs and vaccines.

Founded in 2018, MVMD was originally focused on cannabis cultivation and development of cannabis-derived supplements. Ambitious plans outlined in marketing materials included production centers in Ontario and Vancouver, an advanced indoor growth facility, a partnership with a Jamaican coffee company, and international expansion. But besides a number of equity investments in entities which have since proven disastrous (detailed below), MVMD made little progress.

Several months after going public in March 2020 via reverse takeover, Mountain Valley abruptly divested its remaining cannabis related assets and acquired a “desiccated liposome” drug delivery technology from an entity owned by Michael Farber, MVMD’s Director of Life Sciences. In our view, Farber’s technology is essentially the entire foundation of MVMD today.

MVMD initially applied Farber’s delivery methods to supplements and nutraceuticals in categories such as anxiety, nicotine, testosterone and libido. Then, in another pivot, MVMD shifted attention to vaccines and treatments for polio, tuberculosis, and COVID.

MVMD recorded its first ever revenues in February 2021 when it finalized a licensing agreement with a private mushroom company called Circadian Wellness for C$200k in cash and $50k in equity (we found troubling evidence with regard to Circadian’s management which we highlight later).

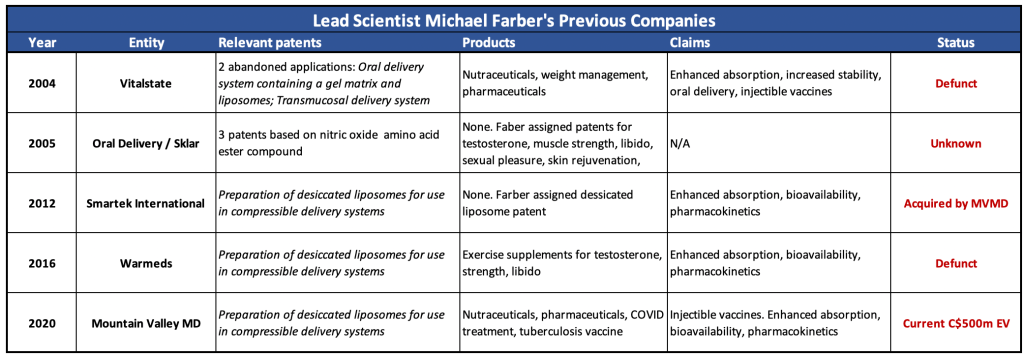

Lead Scientist’s Previous Attempts to Peddle Delivery Technology Ended in Failure

Mountain Valley purports to be on a path to “eradicating the world from disease” and makes bold claims with respect to Farber’s technology and commercial potential. In the words of MVMD’s CEO, Farber’s technology will “change the game on human health in ways that today we just can’t imagine” [17:00].

Yet there is little publicly available information on Michael Farber, odd for a man is in his 60s who has supposedly developed such groundbreaking technology. Searching ResearchGate and Google Scholar for “Michael Farber” or “Mike Farber” produces zero results for published peer reviewed papers. We couldn’t even find evidence of Farber having completed formal scientific education or training. There is, however, documentation of his affiliation with a string of failures.

Vitalstate Inc

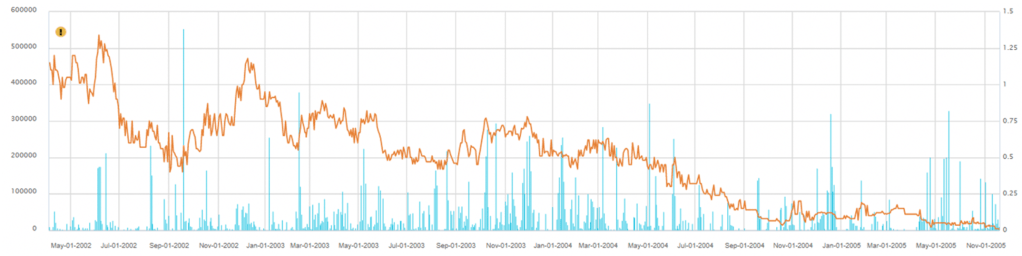

There was Vitalstate Inc, which was formed via reverse takeover in 2001 [Pg.1]. Similar to MVMD, Vitalstate developed nutritional, weight management and pharmaceutical products for animal and human use enhanced by its proprietary “delivery technology”, which the company purchased from Farber and his brother [Pg.9]. Twenty years ago, Vitalstate was advertising its delivery system and making near identical claims to those being made by MVMD today: enhanced absorption, increased stability, oral delivery of injectable vaccines.

In 2004, Vitalstate generated less than $290k in revenue and a net loss of $4.8m. Vitalstate stock was delisted in 2005.

Oral Delivery/Sklar Pharma

Farber next appears in 2005 as founder of an entity known as Oral Delivery Technology Ltd, which changed its name to Sklar Pharma in 2011.

The only information we found on Oral Delivery/Sklar was that Farber assigned Oral Delivery a handful of patents related to the composition of supplements for improving testosterone levels, muscle strength, libido and sexual performance. Seven of nine applications were abandoned. Only one patent was granted, “Nitric oxide releasing amino acid ester compound, composition and method of use”.

WARMEDS

In 2016 Farber co-founded and served as Chief Scientific Officer of WARMEDS, a dietary supplements manufacturer that claimed to deliver “superior sports supplements based on safe and effective active ingredients using a novel and patented delivery technology.”

WARMEDS sold two products: BLOW UP, a pre-workout supplement apparently based on the nitric oxide patent assigned to Oral Delivery, and TESTONE, a testosterone supplement which Farber and company claimed offered “insane muscle size gains, herculean strength gains, and crazy increased libido”. Advertisements touted a “dessicated (sp) liposome technology” developed after “years of exhaustive research” and reference a patented liposomal delivery system.

Source: WARMEDS

Farber has been granted only two patents (in multiple jurisdictions) for his desiccated liposome delivery system. Both are titled “Preparation of desiccated liposomes for use in compressible delivery systems”. The original was filed in 2013 and the second version in 2017 which contains minor changes and appears to encompass the technology’s use in cannabinoids. Both patents underpin Mountain Valley’s current work. Along with a patent titled “Sublingual or buccal administration of melatonin and/or valerian”, which is not being used in any product disclosed by MVMD, we believe these are the only active patents the company currently owns. MVMD says its technologies are based on a “global patent portfolio”. In this case portfolio means three patents, (granted in the US, EU and Canada) two of which have the same title.

An archived page of WARMEDS website contains the most detailed information we found on Farber’s education. In the short biography which describes him as the “world’s most renowned biochemist in the dietary supplement industry”, Farber is said to have “studied in Biochemistry at McGill University.” The extent of his studies is unknown, but it can be reasonably inferred that he did not complete a degree. We asked MVMD for information on Farber’s education and training but have received no reply.

Source: WARMEDS

MVMD Delivery Claims Today Mimic WARMEDS and Vitalstate

The WARMEDS website also made claims about the performance of Farber’s liposome delivery technology. As Vitalstate did in 2001 and as MVMD is doing now, WARMEDS touted improved absorption and bioavailability. The company declared it was the only one using the technology because other “manufacturers are either simply unaware of the problem, clueless of how to fix it, or simply unwilling to hire some of the rare scientists who master these technologies.”

Source: WARMEDS

It appears WARMEDS is no longer in business since the last post on the company’s Facebook page is from May 2019 and warmeds.net is inactive, but consider that less than two years ago, Farber was selling a testosterone booster using the same technology and patent that forms the basis of MVMD’s efforts in vaccines and COVID today.

Exhibit 3. Farber’s previous companies promoted similar technology, made similar claims

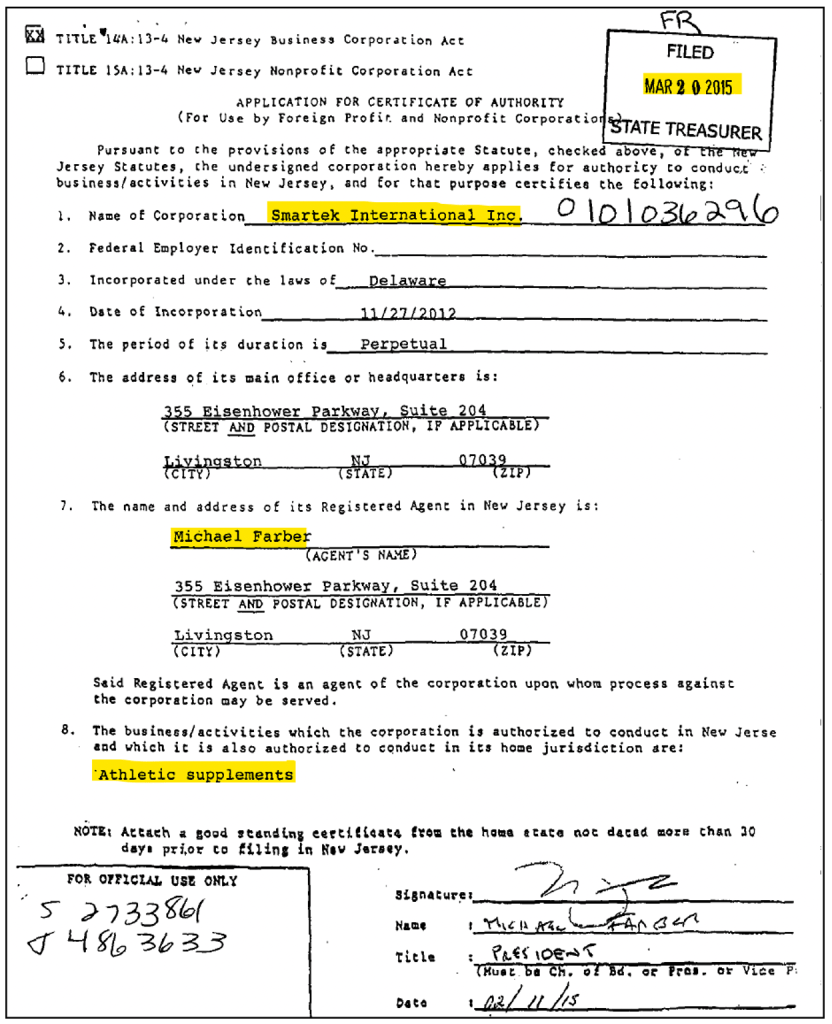

Smartek International

Farber also founded Smartek International which held ownership of the “desiccated liposome” patent eventually acquired by MVMD. Outside of incorporation records, which note that Smartek is also involved in developing athletic supplements, information on the entity is limited. It shares the same Livingston, New Jersey address as Open Delivery/Sklar and WARMEDS. Other businesses at 355 Eisenhower Parkway included VivaLife Travel agency, Integrated Martial Arts and Fitness, and Grooves Unlimited Dance Studio.

Source: New Jersey State Registry – Document by Request

Mountain Valley Management and Employees Appear to Be Devoid of Scientific or Pharmaceutical Experience

While Farber’s scientific experience and credibility is flimsy in our view, given what appears to be a lack of formal scientific training, education or work experience in the pharmaceutical industry, MVMD’s other disclosed employees appear to have none to speak of.

Perhaps not surprisingly, CEO Dennis Hancock has spent most of his career in sales and marketing. Prior to becoming CEO of MVMD, he co-founded PerformanceSPARK, a marketing consultancy with two LinkedIn profiles (Hancock and his co-founder). Prior to that Hancock was on the advisory board of a grocery chain called Organic Garage which has five stores in the Toronto area.

He spent most of his career at Maritz, a sales and marketing company specializing in customer loyalty programs such as travel rewards.

Hancock was also VP of Sales and Marketing at ZENN Motor Company. ZENN manufactured low-speed battery powered cars beginning in 2006. Due to poor sales, ZENN stopped producing cars in 2010 and pivoted to the OEM market, thus far unsuccessfully.

Strategic advisor Leigh Hughes has primarily worked in marketing and branding. He was CEO of a marketing firm and a cannabis company. Hughes has been one of MVMD’s biggest promoters on Twitter and paid promotional videos.

Prior to becoming CFO at MVMD, Aaron Triplett held CFO positions at Hillcrest Petroleum (OTCQB: HRH), bus manufacturer Grande West Transportation Group (OTCQX: BUSXF) and Angkor Resources (PINK: ANKOF), a mineral exploration company.

MVMD advertises a “team” of scientists, but outside of Farber, Mountain Valley has no known employees with science or pharmaceutical development experience. We also find no evidence of any employees outside of CEO Hancock, lead scientist Farber, CFO Triplett, and two junior communications employees – a Communications Coordinator whose only prior work history was an internship at Organic Garage, and a Brand Communications and Technology employee or consultant who is still in college and based on his background was likely hired to manage the MVMD website.

Management Touts Massive TAM but Signs Deal for “Peanuts” with Obscure Mushroom Company Managed by Doctors Alleged to Have Embezzled Taxpayer Funds

Hancock and Farber often tout large addressable markets for MVMD’s products with fatuous soundbites like “hundreds of millions of patients” and suggesting the company has “international attention, potential partnerships… very well known, four corners of the planet” [25:30].

It’s odd then that Mountain Valley would sign its first ever licensing deal with an obscure private psychedelic mushroom company called Circadian Wellness for C$250k, $50k of which was in Circadian equity. Circadian hasn’t begun operations yet, but it plans to eventually grow and process mushrooms for recreational purposes and general wellness supplements. Circadian will also supposedly build a wellness retreat, of which there are renderings on the company’s website.

Source: Circadian Wellness website

If the licensing deal had been for more than a nominal amount of cash (as one of our experts put it, C$200k is “peanuts” in the pharmaceutical world) it could have substantiated management’s comments on large end markets. Instead, prudent investors are or should be scratching their heads.

But what we found when looking at Circadian’s management was even more concerning. Circadian’s Chief Medical Officer and his wife, who is a member of the company’s leadership team in an unspecified capacity, were alleged to have embezzled money from a taxpayer-funded medical clinic they operated.

Dr. Sajeev Goel and Dr. Lopita Banerjee ran the Wise Elephant Family Health clinic between 2010 and 2019. A 2018 audit found Goel and Banerjee funneled C$2.2m from the clinic to pay for investments, personal expenses and vacations. Goel and Banerjee were forced to resign in 2019 and the Wise Elephant clinic was ultimately ordered to shut down in December 2020. Two months later MVMD and Circadian finalized their agreement.

From a complaint filed by Wise Elephant’s restructured board:

“The actions of the Defendant Goel Physicians and the Goel Related Parties, as set out herein, were malicious, oppressive, reckless, wanton, entirely without care, deliberate, callous, willful, and motivated by financial gain.“

That MVMD would engage in such a tiny deal with an unknown entity led by two people alleged to have embezzled any amount of money, let alone over C$2m from a community health organization, is negligent at best and supports our concerns around management and the company’s commercial prospects.

Mountain Valley MD in Cannabis: Capital Destruction

Recall at its incorporation in 2018, MVMD’s was focused on the cannabis market. Investor marketing materials outlined plans to grow cannabis in yet to be built high-capacity facilities in Ontario and Vancouver, plus international partnerships and expansion. However, MVMD made very little progress on its cannabis initiatives. The company was unable to even procure a basic cannabis license from Health Canada – an application filed in 2014 [Pg.128] was dormant as of November 2020. Consider that over 600 licenses have been granted.

Most of MVMD’s tangible cannabis work involved acquiring stakes in five separate cannabis entities, transactions which later proved disastrous. All but one of the acquisitions were written down to zero within a year with total losses exceeding C$10m.

Exhibit 4. MVMD’s cannabis transactions resulted in near total, rapid losses

One such transaction was with CCJC (owned by Christopher Crupi, MVMD’s original founder and CFO). Despite little disclosure, a $1.6 million investment was made in stock and cash, with an option for more. CCJC’s license application was never granted and MVMD wrote its stake to zero, only nine months after acquiring it.

Although Crupi was CFO and an officer at MVMD when the transaction took place – thus being a related party – filings claim that since the transaction was negotiated before Crupi became a principal, MVMD and CCJC were arm’s length parties [Pg.16].

Christopher Crupi was also CEO of Meadow Bay Gold Corp, the failed junior resource miner which served as the shell in MVMD’s reverse takeover. He also co-founded and was CEO and Chairman of Nevada-based cannabis cultivator Flower One Holdings (CSE: FONE). Flower One’s stock is down 80% from the time it went public and the company recently received a notice of default.

Mountain Valley’s Technology: Alteration of Existing Generics

Mountain Valley advertises two primary drug delivery technologies which it trademarked as Quicksome and Quicksol. MVMD doesn’t provide much detail around either one, but in general the company purports that its delivery technologies improve the efficacy and efficiency of existing compounds.

Quicksome allows for the conversion of existing oral or injectable nutraceuticals and pharmaceuticals into sublingual strips, powders, or chews, supposedly offering improvements over standard orals. The advantages, according to MVMD and very similar to those claimed by Farber’s previous entities, include increased bioavailability (amount of drug entering circulation), faster onset, less variability and better precision.

With Quicksol, Mountain Valley claims it can solubilize a group of compounds with low solubility known as macrocyclic lactones which are primarily used to treat parasitic infections in animals. According to MVMD, the Quicksol process uses only approved FDA excipients, thus making it an attractive candidate for human use.

Perhaps the most widely known macrocyclic lactone is ivermectin, a now generic drug originally discovered by Merck in the 1980’s and marketed for veterinary use. Ivermectin has resurfaced as a potential treatment for covid, although with controversy as most of the medical community (including Merck) has criticized the data cited by the drug’s small group of proponents. MVMD is applying Quicksome and Quicksol to ivermectin to potentially treat COVID-19 and coronavirus variants.

MVMD is also attempting to develop Quicksome and Quicksol formulations of currently approved macrocyclic lactones for use in animals. There is also a “dose sparing adjuvant” MVMD says it’s developing and is patent-pending (we find no evidence of Farber having applied for such patent).

The Propaganda

How do the technologies work? Scant details are provided on MVMD’s science. There is next to nothing useful in MVMD’s investor overview, which is the worst example of an investor overview we’ve ever seen. It’s more of an advertisement, repeating the supposed advantages in infomercial-like platitudes such as “Fast-Acting”, “Convenient” and “Minimizes Side Effects”.

Source: Mountain Valley website

The overview also lists the only set of data shared by MVMD, from a pre-clinical safety study of solubilized ivermectin in canines. We discuss the vagaries of the data later in this report, but again the details most relevant to evaluating the potential of MVMD and its technologies are missing.

The Market Overview section contains only a stupefying graphic which itemizes the global pharmaceutical and nutraceutical markets, implying a USD$2 trillion opportunity for MVMD.

Source: MVMD website

Despite providing almost no supportive information on how its technologies work, Mountain Valley has successfully captured the attention of retail shareholders through such tactics as well as aggressive use of paid stock promoters and social media.

We count dozens of paid promotions with well-known stock touts Proactive Investors, Agoracom and Equity.Guru. During advertisements portrayed as interviews, Hancock and Farber make fantastical declarations regarding MVMD’s science (“precision and efficacy will be unmatched, we are certain of that” [4:30]) and dispense pipe dream estimates of market potential (“$10s and $10s of billions of dollars” [9:30]). There are so many examples to choose from, but Hancock claiming MVMD’s tuberculosis treatment, which has yet to enter pre-clinical study, may impact “a quarter of Earth’s population”, is among the more striking comments. Hancock is also very aggressive when opining on MVMD’s stock price: “I feel like we’re the most undervalued stock on the planet” [6:00].

If MVMD isn’t innovating in science, it’s doing so in stock promotion by engaging individuals not typically seen in the world of stock touts. For instance, MVMD hired a YouTube personality with over 2m followers whose channel consists mostly of social commentary and comedic skits. In the below video the personality hypes “multi-billion dollar applications” and “world changing delivery technologies”. He goes on to suggest that “now may be the perfect buying opportunity” due to short attacks depressing prices (the stock was trading at C$1.70).

Source: YouTube

Mountain Valley also breaks new ground by using the personalized video service Cameo to promote its stock. Cameo is typically used as a way for fans to interact with celebrities through videos or chats. MVMD apparently hired Canadian businessman and television personality Kevin O’Leary to film a short shout-out promoting the company. In the 36-second video, posted on Mountain Valley’s YouTube channel, O’Leary says, “MVMD is going to be absolutely terrific…”

Source: YouTube

Based on MVMD’s Instagram account one would expect the company to be a lifestyle brand or marketing firm. The first post, a launch party video, recalls the worst of the initial coin offering craze.

MVMD is the type of company that not only produced the “Infinite Possibilities” video, but also then felt compelled to produce a second version narrated by a “transient poet and voice over artist”.

The Reality: Experts Call MVMD’s Purported Science Not Convincing, Not Innovative, Not Promising

As part of our early work on Mountain Valley, to familiarize ourselves with the science we wanted the unbiased opinions of qualified experts. We searched for specialists in drug delivery, with particular experience in liposomes. Approaching them as investors doing diligence on a company and its technology, we found two willing to share their thoughts. We are protecting their identities in order to maintain their privacy, especially since many of their opinions are critical and we don’t want to risk exposing them to potential abuse.

Topics of discussion included MVMD’s liposome-based technology, commercial potential, pre-clinical data, and the patent.

Expert # 1 is Head of R&D at a leading pharmaceutical company in the oncology space. He has degrees in Biochemistry and Molecular Biology, completing a PhD in Immunology. He has published numerous peer-reviewed papers on vaccines and liposomal delivery. Currently he is developing tissue-specific liposomal nanoparticles for high-efficiency in vivo drug delivery.

Expert #2 has over 20 years of experience in the pharmaceutical industry, holding senior positions including Chief Technology Officer, Head of Pharmaceutical Developmentand Senior Principal Scientist. He has a degree in Biochemistry and a PhD in Biochemistry and Structural Biology. He has worked on 8 approved liposome products and is well-known in the liposome world.

Neither expert had heard of Mountain Valley or Michael Farber, despite working in the same niche of drug development.

Both experts panned what little is disclosed about MVMD’s technology and found it concerning that the company was making large, empty claims without substantiating efficacy data. One even apologized for his negative opinions, saying he wished the company had something more substantial.

When asked for an opinion on Quicksome and Quicksol, both found it difficult to find how the technology was innovative and Expert #2, who has filed multiple successful patents in his roles at publicly traded biotechs, was surprised that the patent was granted:

“I was trying to figure out what novelty there is here and the only thing I could come across was that that method of production, the desiccation method using powdered or liposomal preparation for oral delivery, that’s been tried before, like in the seventies and eighties. So, I struggled to understand what’s novel about this other than the purported bioavailability. I don’t know exactly how thoroughly this patent was reviewed.

I’m really skeptical about the technology. There’s been a lot of failures in this space and it’s a very, very crowded space, which [Farber] admits in the patents and in the papers. And I’m struggling to understand what advantage he’s bringing that others haven’t previously seen.“

Recall that MVMD has only released one set of data – from a pre-clinical safety study of solubilized ivermectin in canines. MVMD often touts the data in stock promotion interviews, calling it “the best pharmacokinetic data for ivermectin in the world.” The company highlights four key findings, and we asked our experts weigh in on each one:

Key finding #1: 800% and 500% increases seen in MVMD’s intramuscular injection (IM) and sublingual strips vs standard oral tablets:

800% increase in bioavailability compared to what, right? I get their press release, but there’s no data backing that up so that you could evaluate was this study even done properly or not.

“I don’t know that the 800% increase in bioavailability of (IM) versus oral for something like this. It may not be very bioavailable. Okay. That’s not surprising, but sublingual that’s, that’s pretty good, right. If that holds up. But is it efficacious? If an efficacious dose is getting a hundred milligrams on board, but maybe they only tested one milligram, you know? So, you can play games.

They are comparing apples to oranges. In no case is injection inferior to oral.“

Key finding #2: TMAX (the time to reach the maximum concentration of ivermectin in the body) at 15 minutes compared to current commercial oral and subcutaneous forms which take between 6 and 36 hours:

“That’s totally expected, any (IM) injection will hit their TMAX much faster than an oral drug because it’s taken up that much faster.“

Key finding #3: No decline in CMAX (peak serum concentration that a drug achieves) over the entire 6-hour period investigated:

“When you see a C-Max that’s flat, that’s usually because the drug precipitated out in whatever space you put it in, and it’s just slowly being absorbed… I would expect for something that’s really solubilized as a drug that it would come up and peak and drop off over a period of time, rather than peak and stay up there. So, peaking and staying up there either means that the clearance of the drug has changed, but I wouldn’t think their formulation would change the clearance of the drug. And so, it’s acting like a depot for some reason. And the only reason why I would think it would do that is because it’s precipitating out in that space. So again, I don’t understand why that’s an advantage or unexpected.“

Key finding #4: Minimal pharmacokinetic variability, with (IM) injection at zero percent variability and sublingual strips at 5% variability compared to 40% variability for oral tablets.

“Anytime you go to (IM) versus oral or parenteral versus oral, you’ll have less variability, that’s completely expected because patient to patient or animal to animal you’ll have more variability with oral uptake just because of what they ate or their gut physiology, things like that. Being less variable, that’s not surprising at all.“

Everybody can enhance pharmacokinetics. Big question is hitting the target.“

Expert #1 was also concerned by MVMD’s lack of focus on manufacturing, which he considers one of the most critical and difficult aspects of delivery technologies.

“Lots of talk about product, but not a single word about manufacturing. This is the difficult part. It took us seven years to master our manufacturing process. If you want to be a serious company, you need to show how you will address the challenges of manufacturing including volumes and quantity.“

We asked Expert #2 to comment on MVMD’s recent announcement that it solubilized another macrocyclic lactone called selamectin.

“I’ve certainly worked with really tough to formulate materials and you can get it to look just like this. For all I know this Quicksol could be a surfactant or detergent that just basically solubilizes. This isn’t tremendously compelling to me… All right I’ll be a little unplugged. [What MVMD has done with selamectin] is an afternoon of work for me. So, I don’t know how complex this is, but certainly I’ve worked with drugs that are hard and we get soluble like that. So, it’s hard to tell from these kinds of press releases how much of a breakthrough that is.

But just because something is soluble doesn’t make it a drug. So, I don’t know how, what they’re showing here translates to improve bioavailability or an improved therapeutic. All you’ve done is got insoluble outside of the lab and maybe there’s hope, but I don’t know that I put a press release around that. So, I don’t know if I’d go so far to call it a joke, but it’s not impressive.“

No development is too insignificant for MVMD to tout in a press release. For example, earlier this month, the company announced it contracted pharmaceutical consultants Camargo Services to support an FDA application for solubilized ivermectin. The implication [11:30] is that Camargo only works with companies developing technologies in which they see value. Expert #2 expressed further doubt:

“I don’t know Camargo themselves. I know other companies and, you know, if you want to pay the money and develop the drug, they’re happy to develop your drug. Right. So, I don’t know if that’s, I don’t know that Camargo is especially selective… I wouldn’t try to confer legitimacy because someone chose a consulting firm, or a manufacturer chose to work with us. I confer legitimacy through data.“

One of the most revealing comments came from Expert #2:

“It’s weird that they’re hyping things that you would expect. And that’s why I don’t understand that, as a delivery scientist, I don’t know if I tout that as one of the key points, except if that’s all I had.“

In summary, two trained scientists and leading experts in the drug delivery sector were extremely skeptical of MVMD. Not only because they believed the data was uninteresting, but also because Mountain Valley chose to portray such data as scientifically meaningful.

Ivermectin: Medical Community Recommends Against Use in COVID

Recall MVMD is furthest along in applying its delivery technology to ivermectin (pre-clinical canine safety study). Ivermectin is currently approved by the FDA for parasitic infections onchocerciasis and strongyloidiasis but it’s not approved to treat any viral infection including COVID. The company plans to engage FDA for approval of its solubilized ivermectin (trademarked as Ivectosol) in the currently approved parasitic indications.

However, Hancock and Farber often discuss its off-label potential in COVID and eventual full approval. In an interview, Hancock suggests it becomes ubiquitous: “Is this sitting in everyone’s cupboard at home like a vitamin C tablet as part of a first aid kit?” [11:00]

While ivermectin has been investigated in COVID and small groups of physicians are advocating for its use, the studies have been criticized by the National Institutes of Health (NIH) for a number of reasons: being too small, inadequately controlled, including patients with different levels of disease and on different background medications.

The Infectious Disease Society of America (ISDA) lists 15 recommendations for COVID, but ivermectin is not one of them. In fact, ISDA recommends against its use saying, “The panel determined the certainty of evidence of treatment of ivermectin for hospitalized and non-hospitalized patients to be very low due to concerns with risk of bias and imprecision. In addition, there were concerns about publication bias, as the available evidence consisted mostly of positive trials of smaller size.”

Last month Merck came out strongly against its use in COVID citing: “1) no scientific basis for a potential therapeutic effect against COVID-19 from pre-clinical studies, 2) no meaningful evidence for clinical activity or efficacy in patients with COVID-19 disease, and 3) a concerning lack of safety data.”

Recent Equitization of Debt at Price Far Below Fair Value with Unknown Counterparty

On December 14, MVMD announced completion of a unit offering for gross proceeds of C$3m at $0.22/share. Hidden at the bottom of the same press release, the company stated it was settling a debt of approximately C$400k with common shares issued at $0.071, with attached two-year warrants for one half of one share exercisable at $0.13. According to the press release, the issuance was reserved for a month earlier in November. A filing two weeks later noted a debt amount of C$470k and 6.6m shares plus warrants. Not until the Dec 2020 quarter filing on March 1, 2021 was it disclosed that MVMD had valued the warrants at zero.

This raises several red flags. Why was MVMD settling debt with shares and warrants far below prevailing market prices? Why was MVMD equitizing debt at a price far below a private placement completed the same day? Why the lack of disclosure? Was this transaction indeed arm’s length as stated? The company claimed the $0.071/unit price was calculated and reserved for in November, but there is no such reservation in the Subsequent Events section of the Sep 2020 quarter statements filed on November 30. Plus, MVMD only traded down to $0.075 for two hours on a single day in November. So why and how was a price of $0.071 calculated? Why were the warrants valued at zero? Valuing the warrant at zero makes no sense since at the time the stock was trading over 50% higher than the warrant exercise price implying that the warrants had significant value.

In sum, these so-called arm’s length parties received the equivalent of nearly 10m shares at more than a 70% discount to settle a C$470k debt. Current value is approximately C$15m.

At best we chalk it up to another head scratching, egregious breach of convention by Mountain Valley. At worst it’s a brazen instance of related party self-dealing. We asked MVMD for comment but have received no reply.

Conclusion: Expect Total Losses

With a C$500m fully diluted EV, one would expect Mountain Valley to have valuable technology and intellectual property, a reputable management team with a track record of success, partnerships with credible counterparties, and a rational pipeline with innovative product candidates. Yet, in our view, MVMD has none of these. We think it has the opposites.

Beneath the glossy videos and paid fake interviews lies a “dessicated liposome” technology that failed repeatedly in the exercise supplements market. Now MVMD expects investors to believe the same technology can revolutionize medicine, eradicate polio and treat COVID. Don’t fall for it.

While shares in the immediate term are worth current cash of C$20m or $0.06/share, in our view they will ultimately prove worthless as Mountain Valley squanders cash on stock promotions, marketing videos, executive compensation, and half-baked science projects portrayed as clinical studies.

Catalysts include the pressure associated with ~20m outstanding warrants exercisable at $0.38/share and 12m options at $0.06/share. And while MVMD can muddle along for a bit issuing press releases highlighting scientific trivialities, eventually there will be regulatory pushback when it engages the FDA or any first world regulatory body. At some point even the most credulous investors will demand results and unfortunately Mountain Valley hasn’t the goods.

We are short MVMD. As stated in a prior article, we are mindful of the current environment in which momentum can account for a larger part of price action than typically seen in the past and we are sized accordingly. Risks to the upside include additional MVMD press releases and external news on ivermectin. That said, we are highly convicted in our bearish view.

In the long run, there is nothing of value here. Our price target is $0.