- NextNav, a failing developer of navigation systems it can’t sell, is petitioning the FCC for a 15-megahertz broadband spectrum grant in a desperate plea for a bailout.

- NN shares are up 300% since 2023 on the potential for a windfall from a deceptively easy change of spectrum rules and a tailwind in the federal government’s push for an alternative to GPS.

- We think bulls underestimate the significance of opposition from band incumbents, the likelihood NextNav would be responsible for tens of billions in realignment costs, and the Trump administration’s recent history against spectrum windfalls.

- Four years after its 2021 SPAC merger, NextNav’s desperately needs a bailout with accumulated losses of $920M and a loss of $100M expected in 2025 on $6M in revenue with $190M in debt.

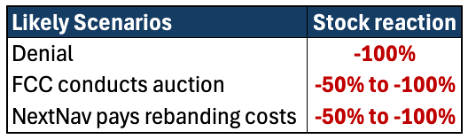

- Based on our research, we think NextNav’s Hail Mary has almost no chance of a clean approval. We think shareholders lose in all likely outcomes.

- We spoke with a former FCC Chairman who believes the petition faces “significant challenges” and is unlikely to move forward.

- Former Chairman thinks FCC will not grant spectrum to NextNav: “I think windfall is a legitimate issue… and it probably gets solved with an auction.”

- If FCC orders an auction of the spectrum, which bulls think could be valued at $1 per MHz-POP or $4B, NextNav would have to raise a huge amount of cash with only ~$176M at end Q2.

- Former FCC Chairman told us NextNav must conduct extensive real world interference tests as requested by the National Telecommunication and Information Administration.

- Former FCC Chairman told us NextNav would be responsible for incumbent re-tuning and relocation costs estimated at over $30B for Part 15 devices.

- NextNav cites a broadband spectrum shortage to support its petition, but Trump administration’s One Big Beautiful Bill Act increases broadband supply by 800 megahertz.

- The domestic policy bill mandates spectrum auctions, not grants, in opposition to NextNav’s proposal.

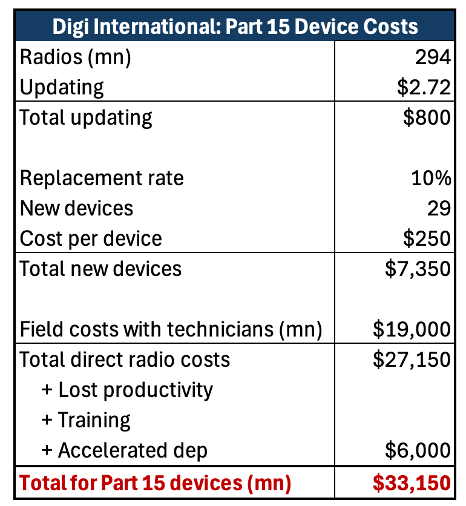

- The status of NextNav’s narrowband license holdings is unclear – 65% are pending construction deadline waiver requests and half of those purchased in 2024 are terminated.

- NextNav’s system is 100% software-based, which MNOs can integrate now at negligible cost without realigning the 900 MHz band – yet none have.

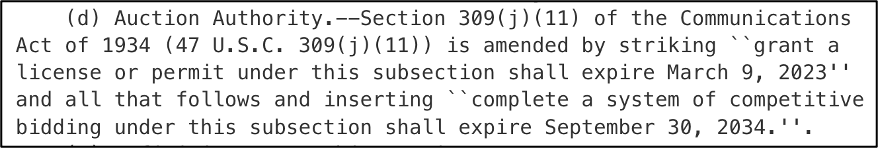

- NextNav’s $2.7B fully diluted EV implies ~$0.70 per MHz-POP, a 200% premium to comp Anterix which owns broadband licenses.

- Opposition to the petition is overwhelming – nearly 2,000 documents in opposition were filed by the FCC deadline. Fewer than 10 were supportive.

- Entities opposing include: Boeing, Avery Dennison, Texas Instruments, Cardinal Health, Dominion Energy, E-Z Pass, Wi-Fi Alliance, Z-Wave Alliance, Airlines For America, Association of American Railroads, U.S. Chamber of Commerce, Apple, and many others.

- We think the petition will be denied or NextNav will be forced to raise massive amounts of capital. Shareholders lose either way.

Disclosure: We are short NN. Please see full disclaimer at bottom of report.

“The Commission should not undermine the public interest to bail out companies whose financial plans have gone awry” – Itron, Inc.

September 4, 2025 — NextNav (NASDAQ: NN) (“the Company”) is a $2.7B Virginia-based developer of geolocation systems. In April 2024, the Company filed an FCC petition requesting a national 15-megahertz broadband license in the “lower 900MHz band” on the basis that it needs the spectrum windfall to operate a backup system to the Global Positioning System (GPS). NN shares are up 300% since the petition filing on hopes of a multi-billion dollar windfall. Anything other than a clean approval will sink NextNav which trades at 450x 2025e revenue, carries $190M in debt, and has accumulated losses of $920M (NextNav has lost money every year since its founding in 2007 as CommLabs). We’re short because we think equity has 50-100% downside in likely scenarios.

We think bulls underestimate the obstacles facing NextNav – the weight of overwhelming opposition from incumbents who say NextNav’s plan would cause material interference, the likelihood that NextNav is responsible for incumbent costs estimated above $30B, and the Trump administration’s reluctance to gift spectrum-related windfalls as recently demonstrated in the C-Band auction in 2020.

NextNav sells terrestrial-based positioning, navigation and timing (PNT) geolocation systems which operate in the lower 900MHz band. The Company proposes to “swap” its 14 megahertz of geographic specific narrowband licenses (many of questionable status) for a 15-megahertz national broadband license worth considerably more (around 500x more). NextNav argues that it needs the subsidy to operate a backup to GPS in the interest of national security.

The April 2024 petition is a sudden pivot for NextNav, which prior to the petition touted a >$100B global TAM and a “growing list of blue-chip customers” [Pg 8]. Management now admits the business of selling standalone PNT systems “is not economically feasible”, hence the Hail Mary pivot to broadband spectrum monetization [Pg. ii]. The problem is that it doesn’t own any broadband spectrum.

The petition has offered investors hope, if only superficial. A current enterprise value of $2.7B implies $0.70 per MHz-POP for NextNav’s narrowband licenses, 300x higher than the value recorded on NextNav’s balance sheet ($0.002 per MHz-POP). At $0.70 per MHz-POP, NextNav trades 200% higher than comp Anterix which owns broadband utility licenses.

We spoke with a former FCC Chairman who told us “NextNav has not achieved the position it was aiming for.” The former chairman thinks the petition has little chance of advancing until NextNav conducts field tests to prove its proposal would not cause interference to incumbents, and even if it does NextNav will most likely have to win the spectrum in an auction and be responsible for rebanding costs. We don’t see how this works out for NextNav shareholders.

We expect shares to retrace the 300% move higher since the petition’s filing and more accounting for $120M in net debt added in Q1 2025. Long term we think equity is worthless as debt outweighs the value of NextNav’s navigation system and narrowband licenses.

NextNav’s Proposal: Bail Us Out

Founded as CommLabs in 2007, NextNav operates terrestrial-based navigation systems in the 902-928 MHz band. Despite claims of best in class technology and a huge TAM, and backing from notable investors, the business has been a complete failure. Four years after a 2021 de-SPAC, NextNav is losing $100M a year on $6M in revenue. No growth, rapidly accumulating losses and almost $200M in debt – NextNav is hurtling towards bankruptcy.

So, NextNav is trying to reinvent itself. In April 2024, the Company filed a Petitioning for Rulemaking requesting a national broadband license and a reconfiguration of the lower 900 MHz band. NextNav says it will deploy a “NextGen” PNT system on ~3% of the spectrum and lease 97% to MNOs, revenue from which would bail it out of the hole it created.

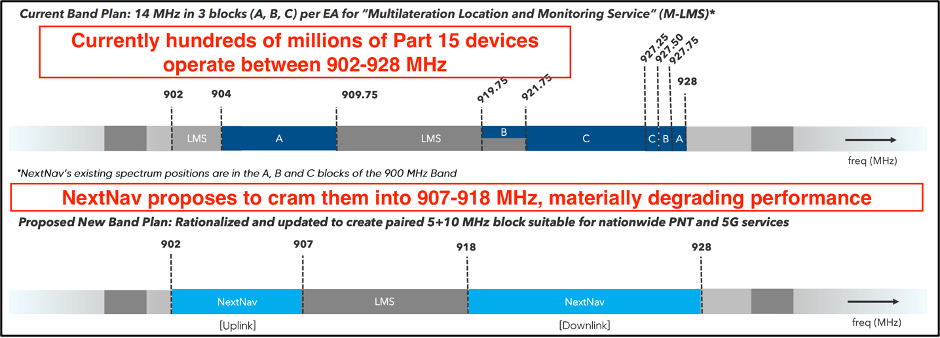

Highlights of NextNav’s primary requests:

- Exchange NextNav’s current spectrum holdings (14 megahertz of narrowband, location specific licenses) for a single 15-megahertz broadband license.

- Create a 5-megahertz uplink at 902-907 MHz and a 10-megahertz downlink at 918-928 MHz solely for NextNav.

- Move incumbent users operating in 902-928 MHz to 907-918 MHz.

- Remove requirement to not cause unacceptable interference to Part 15 devices.

- Remove requirement of pre-deployment field testing to prove non-interference to Part 15 devices.

- Reinstate 129 licenses terminated in 2017 that NextNav purchased in 2024.

In September 2024, the FCC issued a public notice requesting comments to NextNav’s proposal. The opposition was overwhelming as discussed below.

In March 2025, FCC issued a Notice of Inquiry (NOI), Promoting the Development of Positioning, Navigation, and Timing Technologies and Solutions, seeking input on efforts to create PNT systems complementary to GPS.

The FCC has not signaled when it will act on NextNav’s petition.

NextNav’s Proposes to Disrupt a Band in Which Hundreds of Millions of Critical Devices Operate, Generating Billions in Revenue

NextNav asserts that the lower 900 MHz band is “underutilized”, implying a reconfiguration would be harmless. In reality, the band is heavily used by government, private industry, and consumers.

Below are figures describing non-primary traffic in the band from a cogent economic analysis of NextNav’s petition by Furchtgott-Roth Economic Enterprises (on behalf incumbent stakeholders E-Z Pass, International Bridge, Tunnel, and Turnpike Association):

- 294 million estimated Part 15 devices

- 120 million electronic toll tags, accounting for 5 billion transactions

- $23B in toll revenue from 33 states

- 80 billion RAIN RFID tags in the US, 40 billion in retail

- Over 700,000 American amateur radio operators

- Tens of millions of IoT devices employing the LoRaWAN networking protocol

We encourage investors to read the Furchtgott-Roth report. While it’s on behalf of tolling interests, these are influential government or closely related to government agencies that contribute billions to state and federal revenue and play a critical role in the national transportation infrastructure.

The FCC allocated so-called Part 15 devices (unlicensed RF emitting devices) to the lower 900 MHz band in 1985. In 1995, the FCC made allocations in the band for location and monitoring licenses (LMS) of which there are two types: 1) multilateration location and monitoring services (M-LMS) and, 2) non-multilateration location and monitoring services (non-M-LMS). NextNav licenses are M-LMS. Non-M-LMS licensees include tolling authorities, transportation agencies, utility operators, and commercial location/asset tracking services.

To grease it’s pivot to spectrum monetization, NextNav asks for the elimination of a rule requiring pre-deployment field testing to prove it will not interfere with the hundreds of millions of Part 15 devices operating in the band.

Regulation 47 CFR §90.353 governs LMS licenses in the band and provides protection for Part 15 devices. NextNav requests to remove the below text [Pg. A-4] from the regulation:

“…multilateration LMS [M-LMS] licenses will be conditioned upon the licensee’s ability to demonstrate through actual field tests that their systems do not cause unacceptable levels of interference to 47 CFR part 15 devices.”

The petition not only strips Part 15 pre-deployment interference protections, but it also crams Part 15 devices and LMS licensees into a section of spectrum 60% smaller than where they currently operate. Part 15 manufacturers say the narrower spectrum will materially degrade device performance [Pg. 16].

Former FCC Chairman Believes NextNav’s Petition is Unlikely to Be Approved Because NextNav Has Not Proven Non-Interference

Former FCC Chairman: “It’s My Belief That FCC Is Unlikely To Act Absent the NTIA’s Real-World Tests.”

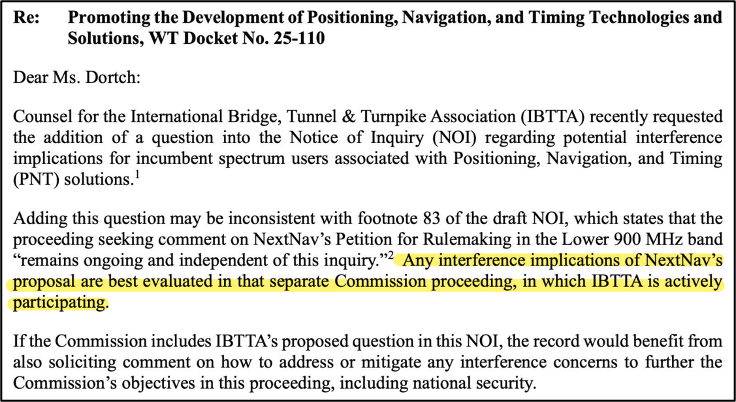

We spoke to a former FCC Chairman who told us they believe NextNav’s position is weak, in part because it has not proven the proposed reconfiguration and PNT operations will not interfere with non-M-LMS and Part 15 users. And the former chairman believes NextNav realizes the petition is weak, demonstrated by its attempt to prohibit discussion of interference in the NOI.

Former FCC Chairman: “NextNav tried to keep out of the Notice of Inquiry any discussion of interference issues. That was a tell, I think, as to where they believe the weakness of their petition lies.

First of all, the NOI itself, something like 19 times, mentioned NextNav. It made it impossible to avoid this question. But there was massive opposition. The NOI was about PNT and reached a conclusion, to me at least, there are systems of systems, multiple systems of systems that can be used, and we ought to just let the marketplace figure it out and not anoint one particular entity.”

Here’s NextNav’s request to exclude from the NOI comments on the interference implications of its proposal:

The former chairman told us that NextNav was defensive and thin-skinned in its response to opposing stakeholders, revealing weakness:

“But a large number of significant players came out of the woodwork in opposition to NextNav because of alleged interference. I thought that NextNav’s reply comments were weak because they got puffy.

NextNav charged false assumptions. They charged vague apprehensions. They charged devoid of legitimate technological analysis and said that the answer to those questions will come when you started [Notice of Proposed Rule Making] on us. That was the key statement as to why I thought NextNav has not achieved the position they were aiming for.

You don’t start an NPRM saying, hey, we think we may do this and we’re not really sure what the interference issues are. When I was Chairman, I had a rule that every NPRM had to have a rebuttable presumption. This is what we are proposing. We are proposing it for the following reasons. Tell us what you think. NextNav’s pushing off a meaningful discussion of interference until later was a cop-out.

When NextNav tried to keep the question of interference out of the NOI, they flagged what their concern is about the whole issue, and that they ought to be living with the FCC engineers to prove their assertion. We have yet to see that. Yes, they have their own studies… But we got to move from paper to real-world studies… And I think [the lack of interference studies] will block things.”

In response to a flood of opposition describing the harmful interference which NextNav’s proposed realignment would cause, the Company submitted a coexistence analysis which predictably dismissed interference concerns.

The former FCC Chairman told us the analysis was unconvincing:

“The ex-parte that NextNav had with the engineers at the FCC, when I looked at that, I highlighted one thing where they said that they’re basing everything on the assertion that the 5G standard, by itself, will avoid interference.

My problem is that if I put myself in the shoes of the chairman rather than an advocate, I have a hard time seeing how they have made the case that they can avoid all of the interference.”

“It’s my belief that the FCC is unlikely to act absent the NTIA’s real-world tests.”

Multi-Billion Dollar Windfall Flouts Communications Act

A clean approval converts NextNav’s narrowband LMS licenses into a flexible use nationwide broadband license, plus an extra 1 megahertz donation. The 15-megahertz license would represent 4B MHz-POPs (product of bandwidth and population covered) which could be worth $4B, assuming a value of $1 per MHz-POP.

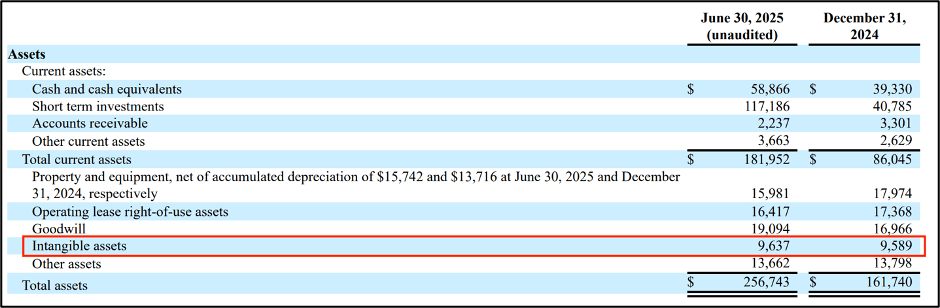

On its balance sheet, NextNav values its 14 MHz of LMS licenses at only $9.6M, yet it paints the proposed transaction as a license “swap”:

“The current M-LMS band plan does not support robust PNT or integration into broadband networks. NextNav therefore requests a “swap” in which NextNav will return all active licenses and associated applications and petitions in exchange for a nationwide license consistent with the new 15-megahertz band plan configuration. [Pg. 29]

Compare the value of NextNav’s license portfolio to that of Anterix (NASDAQ: ATEX). Anterix owns 6 MHz of low-band broadband spectrum representing 1.8B MHz-POP which it values at $240M. Anterix currently trades at a $400M EV, 85% below NextNav.

Four months after NextNav filed the petition, the FCC’s Wireless Telecommunications Bureau (WTB) and the Office of Engineering and Technology (OET) filed a Public Notice seeking comments on the petition, underlining key issues of concern including the windfall to NextNav (note that NextNav never used the term “windfall” in the petition indicating it prefers to downplay the issue).

“Finally, we seek comment on the windfall that NextNav might receive as a result of its proposed spectrum swap for a new nationwide license, including the acquisition of accompanying rights as a licensee and lessor, the application of flexible use and less restrictive technical rules to this band, and how the Commission should address any such windfall.” [Pg.6]

Out of almost 2000 comments filed before the 30-day deadline, less than 10 were in support of NextNav. Many large incumbents, including toll and vehicle enforcement company Neology and electric services company Dominion Energy, eviscerated the petition on grounds that NextNav’s true intention was to maximize its share price.

“The NextNav proposal should not be treated as a necessary solution to a matter of public policy given that the USDOT Volpe Center is already evaluating at least 8 alternative solutions, but as a proposal engineered instead to maximize the value of NextNav’s assets.” – Neology, Inc [Pg. 6]

“NextNav seeks to obtain a significant windfall for itself with little to no corresponding public interest benefits.” – Dominion Energy [Pg. 6]

Responding to the criticism, NextNav limply stated, “this arrangement does not result in a windfall to NextNav”, without offering evidence or substantiation [Pg. 30].

Former FCC Chairman: “I Wouldn’t Be Surprised If There’s An Auction”

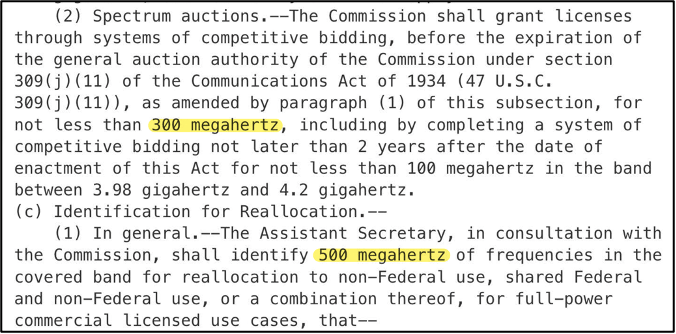

If the FCC agrees to reconfigure the band as NextNav proposes, it’s difficult to see how the agency isn’t statutorily required to conduct a public auction. Section 309(j) of the Communications Act orders competitive bidding if there are likely to be mutually exclusive applications for spectrum – and there would be interest in newly free low-band broadband spectrum.

The FCC can make grants of spectrum but its typically under strict terms to non-commercial entities. We discussed the risk with the former FCC Chairman who told us the FCC will most likely settle the windfall question by conducting an auction:

“NextNav wants a windfall. It could be that [the spectrum] gets opened up for a price, or there’s an auction. I would not be surprised if there would be an auction.”

The former chairman told us the value discrepancy between NextNav’s current license holdings and a national flexible-use license is too wide, necessitating an auction.

“Let’s start with the fact that the megahertz NextNav has, they don’t have national coverage to begin with. They got a lot of POPs, but they don’t have national coverage, so they don’t have every license for the small amount of spectrum they already have. I think windfall is a legitimate issue… and it probably gets solved with an auction.”

Former FCC Chairman: C-Band Auction Precedent Shows Trump is Against Anti-Competitive Spectrum Windfalls

We asked the former chairman about the likelihood of an FCC approval without an auction of the spectrum. They thought the chance was very low and referenced the C-Band auction as a precedent.

In 2019, to expand the amount of spectrum available for 5G wireless services, the federal government instructed the FCC to reallocate several hundred megahertz of mid-band spectrum held by satellite operators. Then FCC Chairman Ajit Pai with staff member and current FCC chairman Brendan Carr, were steering the reallocation towards a private auction in which the satellite operators would receive windfall payments directly from MNOs. However, President Trump intervened, instructing Pai and Carr to conduct a public auction under which the US government would collect all sale proceeds .

“Let’s go back to the experience in the first Trump administration with the C-band auction, in which then Chairman of the FCC, Ajit Pai, aided by his staff member, Brendan Carr, wanted to have a private auction of C-band spectrum used by the satellite companies so that the companies could profit from that…

Pai was proceeding through that process until, all of a sudden, he got a call from the president of the United States, Donald Trump, who said, what the hell are you doing? Ajit immediately switched from the potential windfall of these licensees being able to have a private auction for their spectrum to holding a public auction.

Windfall profits is a very real issue [for NextNav]. Donald Trump personally has already expressed himself on that previously. Brendan Carr personally has already been up close and personal in assisting the chairman and he got his fingers burned by trying to do something that was characterized as windfall. “

President’s Trump’s history against spectrum windfalls and FCC Chairman Carr’s C-Band experience isn’t priced into NextNav stock, in our view. And the former chairman told us that every decision is tightly controlled by the chairman:

…make no mistake about it, at the FCC, every decision is made by the chairman. The commissioners don’t even get to vote on something unless the chairman puts it on the agenda. Whatever they end up voting on, the chairman has approved every word.”

Note the C-Band satellite companies (Intelsat, SES, and Telesat) offered to pay $8B to the US Treasury under a private auction in hopes of preventing a public auction. NextNav isn’t even proposing any similar payment.

The risk that FCC directs an auction of the spectrum is noted in NextNav’s 2024 10-K:

“If the FCC does reconfigure the spectrum, and it regains auction authority, it may decide to use an auction as part of the process of distributing the licenses. We may be required to participate and compete with other bidders in such an auction, with no certainty of winning.” [Pg. 20]

The former chairman also believes the FCC could sell the national broadband license to NextNav. Section 309(j) of the Act (Recovery of Value), prescribes that entities receiving spectrum awards will pay an amount determined by comparable transactions. In such a scenario, assuming a spectrum value of $1 per MHz-POP, NextNav would be forced to raise over $4B, crushing current shareholders.

Former FCC Chairman: Assuming Realignment Approval, NextNav Would Pay Considerable Incumbent Realignment Costs

The former FCC chairman also told us even if the realignment is approved and NextNav wins the spectrum at auction, they don’t see how NextNav avoids paying device retuning and replacement costs:

NMR: “In the event of a NextNav approval. Who will bear the realignment costs? Is there any way that NextNav avoids those costs?”

Former FCC Chairman: “I doubt it… an example is the C-band being repurposed for terrestrial use. The FCC auctioned the spectrum, and the winners of that spectrum had to pay collectively another $13 billion to pay for the transition after they paid the US government. So, yes there is a cost associated with success.”

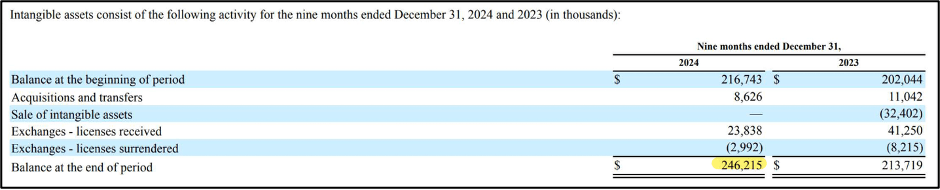

Digi International (NASDAQ: DGII), a wireless communication and IoT device company, estimated the retuning costs for Part 15 devices in the 900 MHz band if NextNav’s petition is approved. Digi calculated the transition would involve approximately 294 million Part 15 radios the transition of which would conservatively cost between $27B to $33B.

NextNav Says Petition Eases Broadband Spectrum Shortage, But One Big Beautiful Bill Act Frees 800 Megahertz and Mandates Spectrum Auctions

NextNav points to a broadband spectrum supply shortage to support a reconfiguration asserting the “Lower 900 MHz Band is an ideal candidate for swift FCC action.” This talking point was recently spoiled by the Trump administration.

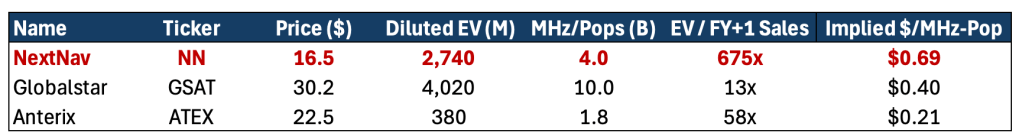

In July, the administration’s One Big Beautiful Bill Act became law. The Act mandates the auction of 800 megahertz of spectrum in the 1.3 GHz to 10 GHz range for broadband use.

Moreover, the bill orders auctioning spectrum, rather than selectively awarding it to private sector entities.

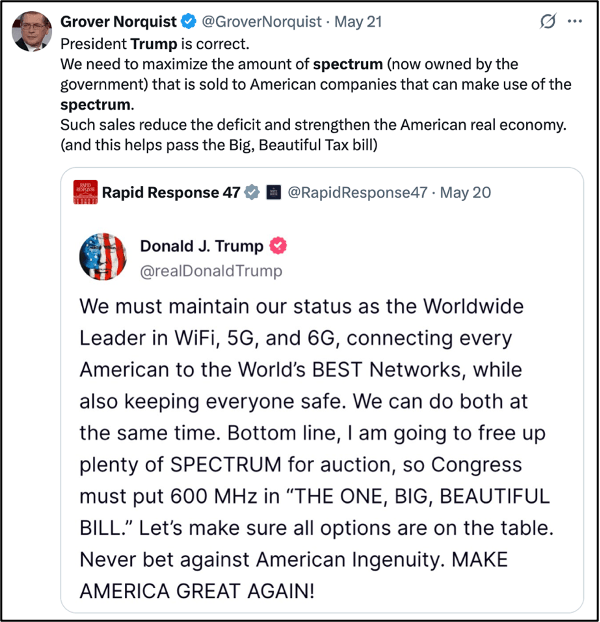

The expansion of available spectrum through auctioning was explicitly supported by President Trump in a Truth Social post. And Grover Norquist, founder of the influential advocacy group Americans for Tax Reform, noted revenue from such spectrum auctions would reduce the deficit. In the context of the administration’s prioritization of spending reductions (see DOGE), the probability of a multi-billion dollar spectrum gift to NextNav is even more remote.

The domestic policy bill also reinstates the FCC’s auction authority which expired in March 2023, clearing the way for spectrum auctions:

Although the federal government’s push for alternatives to GPS is a tailwind for NextNav, the government’s treatment of spectrum as a taxpayer owned asset that should be allocated using auctions bars a clean FCC approval, in our view. Especially considering there are viable GPS alternatives that don’t involve grants of spectrum, realigning spectrum, harm to incumbents, and multi-billion dollar regulatory windfalls.

NextNav cites the realignment of the 800 MHz/1.9 GHz bands in 2004 as a precedent in which the FCC issued wireless licenses without conducting an auction [Pg. 34]. But the purpose of that rebanding was to eliminate interference between public safety and commercial wireless systems, a much different circumstance. Moreover, in that case Nextel was required to pay all realignment costs in the form of a $2.5B letter of credit. A similar requirement in NextNav’s case would likely total multiples of that figure and wipe out current shareholders under material dilution and/or debt.

Alternative Terrestrial-Based GPS Systems Exist Without The Costs Associated With NextNav’s System

Other terrestrial-based PNT alternatives to GPS exist without the massive costs and dislocations associated with NextNav. The Resilient Navigation and Timing Foundation, an advocacy group that encourages development of terrestrial-based navigation and timing systems, outlines several leading systems [Pg. 7]:

- Locata and PhasorLab – Short-range terrestrial beacon system that uses Wi-Fi. Centimeter positioning accuracy for container ports and other users. Locata is the PNT system for the USAF at White Sands Missile Base.

- Broadcast Positioning System (BPS) – Successfully demonstrated to the National Institute of Standards and Technology, BPS uses existing tower infrastructure and existing emergency broadcast spectrum and does not interfere with ATSC 3.0 TV signals.

- eLoran – Even NextNav admits eLoran is a “suitable substitute for GPS” [Pg. 177]. Modernized radio navigation system developed in response to GNSS vulnerability based on 80 years of successful Loran-based PNT. Operates on 90 kHz to 110 kHz, which is reserved for radio navigation. eLoran systems used by China, Russia, South Korea, Saudi Arabia, and the United Kingdom.

- NITRO – National Guard’s National Integration of Timing Resilience for Operations (NITRO) project deployed terrestrial timing backup in eight states.

In the petition, NextNav touts grant funding from the U.S. Department of Transportation’s initiative to explore alternative GPS systems. But 8 other developers (including Locata) also received grants as part of the program, none of which require rule changes and reconfiguration of a critical band of spectrum.

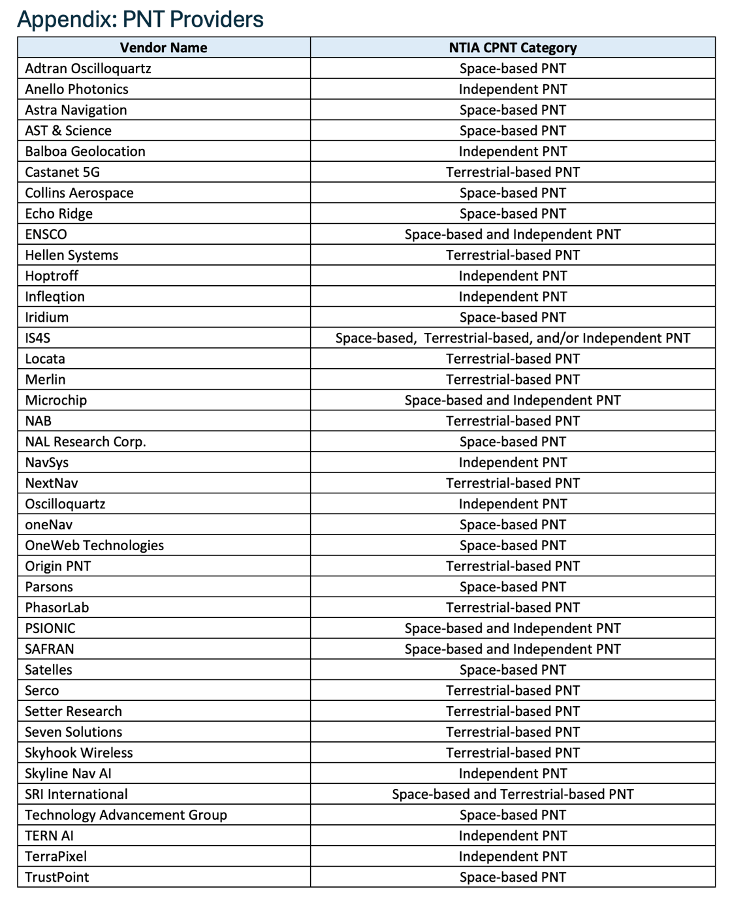

In fact, dozens of GPS alternatives exist that do not require sweeping reconfigurations with collateral damage to incumbents, information the FCC is well aware of.

National Telecommunications Information Administration, Advisor to President, Likely Views NextNav and It’s Petition With Contempt

The National Telecommunications Information Administration (NTIA) filed a document into the NOI record highlighting 50 alternative GPS systems (Appendix 2). The NTIA filed the document two weeks after the NOI was closed for comments on May 13, which the former FCC chairman found noteworthy – suggesting the agency felt compelled to clarify that dozens of GPS alternative systems exist besides NextNav.

Former FCC Chairman:“I do find it interesting that NTIA filed in the NOI, after it closed by the way… here are all the available alternatives for PNT backup, mentioned NextNav, and then a laundry list of, here’s people who say they can do it…”

And when describing NextNav’s PNT system, NTIA used particular language. NTIA says NextNav “claims” the signals from its navigation system are stronger than GPS, and NextNav “claims” the prior generation system is in “72 top US markets”. NTIA doesn’t use the verb “claims” anywhere else in the document which describes dozens of GPS alternatives.

To clarify, the following is Oxford’s definition of “claims”:

“state or assert that something is the case, typically without providing evidence or proof.”

Moreover, the NTIA hinted at the nearly 2000 filings (select filers listed in Appendix 1) in opposition to NextNav’s proposal: “Many stakeholders have already voiced their opinion on NextNav’s 900 MHz proposal in WT Docket No. 24-240.”

The NTIA’s language barely conceals the agency’s contempt for NextNav’s petition, in our view. If the NTIA holds a negative view of NextNav and its proposal, the petition faces an improbable climb considering the agency is the president’s primary advisor on telecommunications policy as it pertains to regulations and technological advancement.

NextNav Proposal Cites High Costs of Implementing System, Yet CEO Touts Negligible Costs on 1Q25 Earnings Call

NextNav asserts it would bear “considerable costs associated with creating a reliable and precise TPNT complement and backup to GPS”, implying that such costs should be weighed against the huge windfall it would receive [Pg. 30]. However, based on comments from CEO Miriam Sorond during the Q1 2025 earnings call, the costs of operating NextNav’s system with an MNO, as it proposes, are very low (think SaaS margins).

Analyst: And you’d use [MNO] towers, their backhaul, and their kind of core infrastructure to route your signals?

Sorond: Yes, the signal is embedded in the 5G. So, it’s already whatever routing mechanism, the same equipment that you use for 5G broadband is actually going to turn on this signal, with same routing mechanisms, and then we actually detect and derive the signal within an end user device. It’s 5G-based. And our solution is just software…

Analyst: And in terms of the client processing capability to derive the signals, does it run in software, or do you need another chip to process?

Sorond: No, just software. Our solution is 100% software-based for extracting the positioning, yes.

Analyst: How expensive would this be to deploy for an MNO if it’s software-based?

Sorond: The CapEx or any addition would be similar to any other spectrum, which they do all the time. Because we’re exactly not going opposite direction on the need for more capacity or coverage. They’re going to continue to spend the money to add spectrum to their networks. As far as whether it’s expensive to add our software, no, again, laying over a software layer is not at all. It’s not a hardware modification, it’s not an additional equipment, which makes — which would then make it additional cost to what they routinely do to add spectrum. So, we don’t have any of those.

Sorond was touting how easy it will be for MNOs to integrate the NextNav system because the costs of integration are negligible. In this context, NextNav’s claims that it bears “considerable costs” are untruthful and we believe the FCC will notice.

FCC Will Know MNOs Don’t Want to Use NextNav’s System

The analyst also asked an obvious but important question: if the system is all software, why don’t MNOs use it now?

Analyst: Why wouldn’t they all deploy this, maybe on existing spectrum now, if it’s feasible just to add in?

Sorond: You ask a really good question on why wouldn’t they do this now? If it’s there they can. They can actually turn on the PRS signal or in a 5G network or CRS signal on a 4G network. But it is a 5% capacity hit to their networks. So, basically, they would be giving up 5% of their capacity, which is generating mobile broadband revenue. That’s one problem. The second problem is, just turning on the signal is not enough. You have to kind of then have, NextNav has the expertise, the licensing, the IP, the software to be able to then take that signal and convert it to positioning and timing.”

Sorond is confused or is intentionally obfuscating in her response. She says the NextNav system would occupy 5% of the 10 megahertz downlink band the Company proposes, which is a negligible amount of spectrum for MNOs which on average own several hundred megahertz of capacity. Sorond then says MNOs aren’t deploying NextNav because they need NextNav IP and expertise, which is true but only because MNOs aren’t currently using NextNav.

That MNOs could have implemented NextNav’s system for years but haven’t underlines the perverse incentives created if the petition were approved, an issue surely not lost on the FCC.

Moreover, since MNOs can operate the system now, NextNav could propose options for deployment on other parts of the spectrum not as heavily used as the lower 900 MHz band. But NextNav hasn’t because its ultimate goal is a spectrum windfall and not PNT.

NextNav Has Warehoused Spectrum Since 1999. Hundreds of NextNav Licenses Are Terminated or Pending Construction Extensions

Most of NextNav’s 14 megahertz of licenses were purchased at auction in 1999 for $2.4M by Progeny, a subsidiary. Licenses totaling 4 MHz were purchased in March 2024 from Telesaurus Holdings GB LLC and Skybridge Spectrum Foundation for $30m plus $20m contingent on the FCC recognizing the licenses as valid and approving NextNav’s petition.

The FCC requires that LMS spectrum licensees use the spectrum for LMS purposes, evidenced by construction of LMS equipment such as towers and beacons. In doing so, FCC discourages acquisition of spectrum solely for investment purposes.

However, NextNav/Progeny has essentially warehoused the spectrum it has owned since 1999, delaying construction on many licenses since then. Since 2005, NextNav has repeatedly sought and received FCC relief of construction deadlines – in 2008, 2012, 2014, 2015, 2019, 2020, 2021, and in January 2025 [Pg. 31]. NextNav’s purported plans to build, should be considered against this record of delays.

In fact, of NextNav’s 226 active licenses (2 have been terminated), 148 or 65% are under extension requests which remain pending [FCC ULS].

In its request for comments, FCC presents the difficulty of approving NextNav’s petition considering the Company proposes to exchange narrowband licenses (some terminated) warehoused for 25+ years, for a license covering commercial broadband applications.

“We seek comment on the relationship of the requested swap to Progeny’s prospective compliance with license conditions applied to its M-LMS B and C Block licenses through prior grants of relief, as well as its currently pending requests for relief. We also note that Progeny’s A Block licenses were terminated and, unlike its B and C Block licenses, were not authorized by the Commission for commercial operations.”

The status of the 4 megahertz of licenses purchased from Telesaurus is even more in question: 128 are active (but have pending extension applications) and 129 were terminated in 2017 for failure to meet construction requirements.

In addition to the 128 active but pending licenses, NextNav purchased the rights to a petition for reconsideration filed by Telesaurus in 2017 to have the 129 terminated licenses reinstated. In NextNav’s proposed spectrum exchange, it is assumed these 129 terminated licenses will be reinstated and assigned to NextNav.

In April 2024, NextNav, through Progeny, applied for the FCC’s consent to transfer ownership of the Telesaurus/Skybridge licenses to Progeny. In June 2025 presumably due to opposition from band stakeholders, NextNav/Progeny amended the application to remove the terminated licenses from consideration. It is not clear how NextNav plans to accomplish its PNT vision without the reinstatement and transfer of the 129 terminated Telesaurus/Skybridge licenses.

Plainly Biased Survey Touted as Evidence of Public Support Reveals Desperation

NextNav hired polling firm Public Policy Polling to measure public opinion on a ground-based backup system to GPS. In March, NextNav touted the results, painting them as evidence of overwhelming bipartisan support for the Company’s PNT system and FCC rebanding petition.

NextNav said, “by a margin of ten-to-one, voters support the creation of a ground-based complement and backup to America’s Global Positioning System (GPS)”. However, the poll used painfully obvious leading questions to manufacture results.

Prior to asking questions, respondents were reminded of the importance of GPS, with statements such as, “GPS is an incredible technology that has become increasingly important to our day-to-day lives” and it “helps first responders to find people in emergencies”.

It’s not surprising most people responded in support of a “free” backup system to GPS in questions like the following:

“Currently, the United States has no backup to this single network if there is a GPS outage or GPS signals are obstructed. The Federal Communications Commission or FCC is considering a proposal that could change this. If adopted, the proposal would create a groundbased complement and backup to GPS. This would help ensure that we can rely on accurate location and timing services, even if GPS is unavailable, at no cost to taxpayers. Would you support or oppose the creation of a groundbased complement and backup system to GPS?”

We think the sponsored poll reveals desperation in NextNav’s efforts to convince stakeholders and the FCC to support the petition. That NextNav, a $2.7B company claiming it can operate a national backup to GPS, feels compelled to employ such gimmicks calls into question the state of the petition.

High Profile Investor Senior to Equity

Bulls point to the involvement of M-Cor Capital (investment arm of Milliken Family Office) whose CEO, Josh Lobel, was appointed to the President’s Intelligence Advisory Board in February 2025. M-Cor along with Fortress Investment Group were lead investors in NextNav’s $190M convertible notes issue in March 2025.

We acknowledge Lobel’s connection to the President has bullish implications. However, M-Cor’s owns NextNav debt (convertible with warrants) but no equity. In an FCC denial, NextNav debt is secured at least partially by cash.

Undeserved Premium, Investors Lose Either Way

NextNav’s $2.7B enterprise value represents a significant premium to Anterix, a broadband provider to utility companies and NextNav’s closest comp in that both are primarily spectrum monetization stories. Granted, the NextNav bull case is predicated on a potential spectrum windfall, but we think bulls are mispricing the risks to approval especially in the context of the current value of NextNav’s license portfolio which was recorded at only $9m at Q2 2025. NextNav also trades at a premium to Globalstar (NASDAQ: GSAT) despite GSAT operating an underlying business generating substantial revenue.

Notwithstanding the stretched premium to comps, we think best case current shareholders get buried by dilution after NextNav is required to buy the spectrum at auction and pay for retuning costs estimated at over $30B. If the FCC flatly denies the petition, we think equity trades to $0 as debt dwarfs asset value.

The cost-benefit analysis before the FCC is so heavily weighted against NextNav – the costs (millions of consumers affected, multiple critical industries displaced and saddled with retuning costs, the perverse incentives established in an approval, etc) are so imbalanced against the benefits of a system in concept only which NextNav purports it can operate but never has.

Appendix 1: Selection of entities that filed comments opposing NextNav’s proposal

- 6C Coalition

- Alarm Industry Communications Committee

- American Honda Motor Co.

- ARRL, The National Association for Amateur Radio

- WISPA – The Association for Broadband Without Boundaries

- Avery Dennison

- Bay City Bridge Partners, LLC

- The Boeing Company

- California Toll Operators Committee

- Cardinal Health

- Continental Automotive Systems, Inc.

- Decathlon

- Digi International Inc.

- Dominion Energy, Inc.

- The E-ZPass Interagency Group

- Eaton

- EchoStar Corporation

- Generac Power Systems Inc. / ecobee

- The Edison Electric Institute

- EnOcean

- The Enterprise Wireless Alliance

- The Georgia State Road and Tollway Authority

- The Golden Gate Bridge, Highway and Transportation District

- The GPS Innovation Alliance

- Arlo

- Cisco

- Landis+Gyr

- The Illinois State Toll Highway Authority

- The International Bridge, Tunnel & Turnpike Association

- Itron, Inc.

- The LoRa Alliance

- Motorola Solutions, Inc.

- The National Association of Broadcasters

- The Internet & Television Association

- Neology, Inc.

- OmniAir Consortium, Inc.

- Open Research Institute, Inc.

- The Port Authority of New York and New Jersey

- RAIN Alliance Inc.

- RAIN RFID Coalition (Avery Dennison Corporation, Impinj, Inc., r-pac International Corp., and Zebra Technologies Corporation)

- Red Cat

- The Resilient Navigation and Timing Foundation

- The Security Industry Association

- Southern California Edison

- Texas Instruments Incorporated

- TransCore

- The Utilities Technology Council

- Vivint

- The Washington State Department of Transportation

- Wi-Fi Alliance

- The Wi-SUN Alliance

- Wireless Broadband Alliance

- The Z-Wave Alliance

- A Coalition led by the US Chamber of Commerce

- Apple

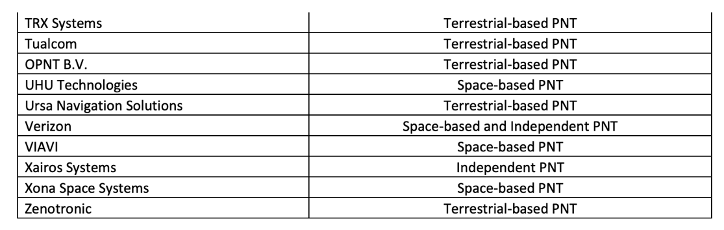

Appendix 2: PNT Providers filed into NOI record by NTIA

Disclaimer

As of the publication date of this report, Night Market Research (NMR) and Connected Persons (as defined hereunder), along with or through its members, partners, affiliates, employees, clients, and investors, and/or their clients and investors have a short position in the securities covered herein (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the price of any stock covered herein declines. NMR and NMR Connected Persons are likely to continue to transact in the securities covered herein for an indefinite period after an initial report, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in NMR’s research.

Use of NMR’s research is at your own risk. In no event shall NMR or any NMR Connected Person be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. NMR is not registered as an investment advisor in the United States, nor does NMR have similar registration in any other jurisdiction. To the best of NMR ‘s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources NMR believes to be accurate and reliable, and who are not insiders or connected persons of the issuer covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. NMR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and NMR does not undertake to update or supplement this report or any of the information contained herein.

NMR Connected Person is defined as: NMR and its affiliates and related parties, including, but not limited to any principals, officers, directors, employees, members, clients, investors, and agents. One or more NMR Connected Persons may have provided NMR with publicly available information that NMR has included in this report, following NMR’s independent due diligence.