- Patriot Battery Metals is a rare mining “unicorn” – a lithium explorer ascending to a $2bn valuation despite having acquired its core asset for $8m only 16 months ago (a 250x return) and lacking an established maiden resource.

- We think Patriot’s rally can in part be attributed to stock promotion with marketing outlets which other supposed “Tier-1” developers would avoid.

- The emerging miner struck a $1.5m promotion deal with an unknown entity based in a suburban house. Its sole principal has been involved in psychedelic mushroom and cannabis nanocaps down 99% from highs.

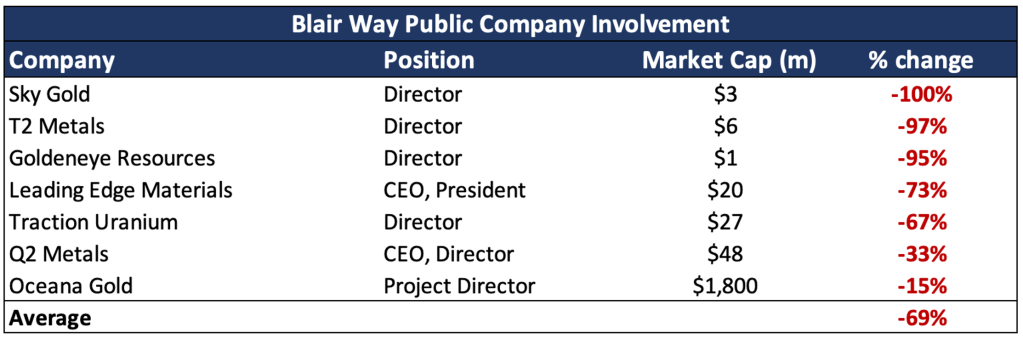

- Patriot’s leadership has a history of shareholder value destruction. The CEO was an insider at 7 public companies down on average 70% during his tenure. Six of the seven companies are currently nanocaps

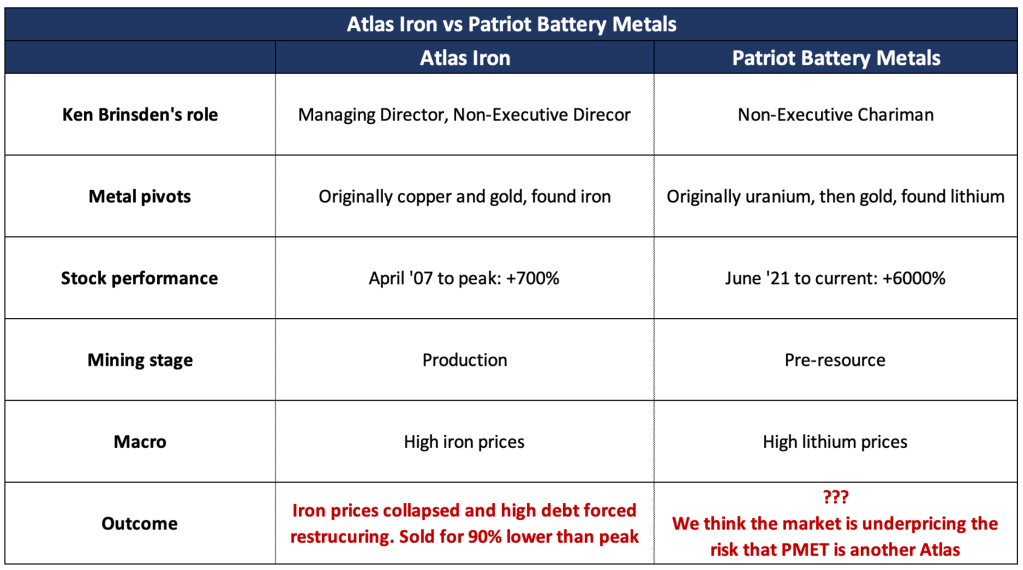

- Ex-Pilbara CEO Ken Brinsden’s appointment as Non-Executive Chairman has buoyed the stock. Yet, Patriot also mirrors his time as MD at Atlas Iron. Like Patriot, Atlas soared on a pivot to a hyped metal but eventually restructured and sold at a 90% discount to its peak valuation.

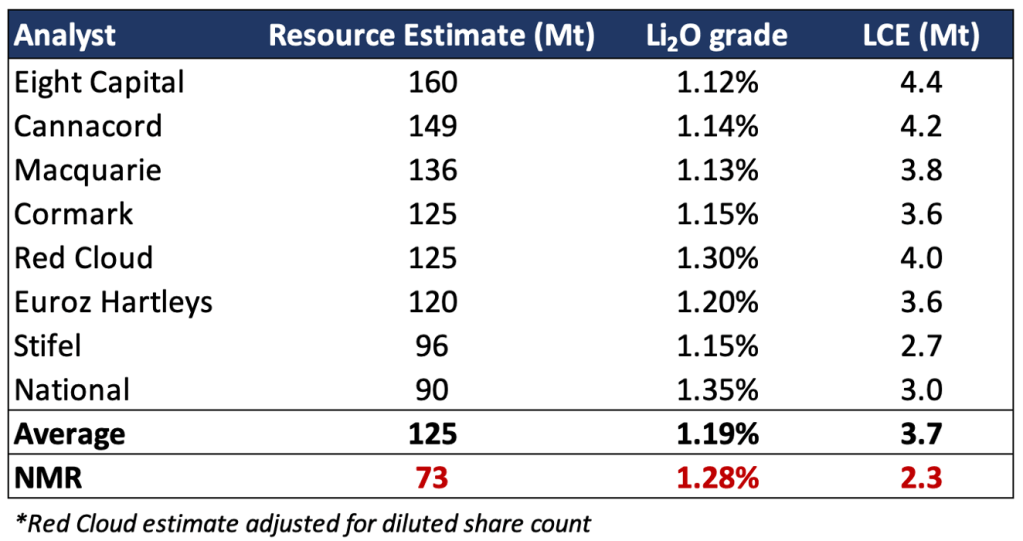

- Expectations for Patriot’s initial resource estimate are sky-high. CEO Blair Way touts “triple digit” figures and recently suggested Corvette exceeds Liontown’s 171Mt of 1.4% Li2O. Using generous assumptions, we estimate an initial resource below 100Mt or 3.2Mt LCE, over 40% lower.

- We think management over-touted resource figures, leading Patriot to delay an initial MRE at least seven times (and counting). First targeted for Fall 2022, guidance is now set for late-July 2023.

- Patriot’s lack of disclosure of industry standard data bodes poorly for results. The Company hasn’t published cross sections since June 2022. CEO explains he’s willing to show geologists, but investors will misinterpret. What are they hiding?

- Management also touts production by 2028, a stretch even under normal circumstances. Considering ecological sensitivity of the location (much of it under a lake) which should complicate permitting and construction, we think Corvette is a 2032+ mine. Where will lithium prices be then?

- Known mining investors and promoters orbit in the background. One such investor promotes Patriot on Twitter without disclosing an award of ~5m shares (current value >$75m) for brokering a private placement.

- We question the involvement of a popular junior mining entrepreneur who admitted to over-inflating an asset by 9x or $4.8bn. The stock, in which he was a director and significant shareholder, is down 95% since.

- Since then, multiple buyout rumors have distracted from resource delays and sector risk, all implausible given the Company’s early stage, nosebleed valuation and suspect sources. Pilbara even denied interest citing Patriot’s long time to production.

- Next year’s lithium market could be a bloodbath. Despite already having declined 40% YTD, Goldman Sachs expects oversupply in 2024 and spodumene prices 50% below current spot.

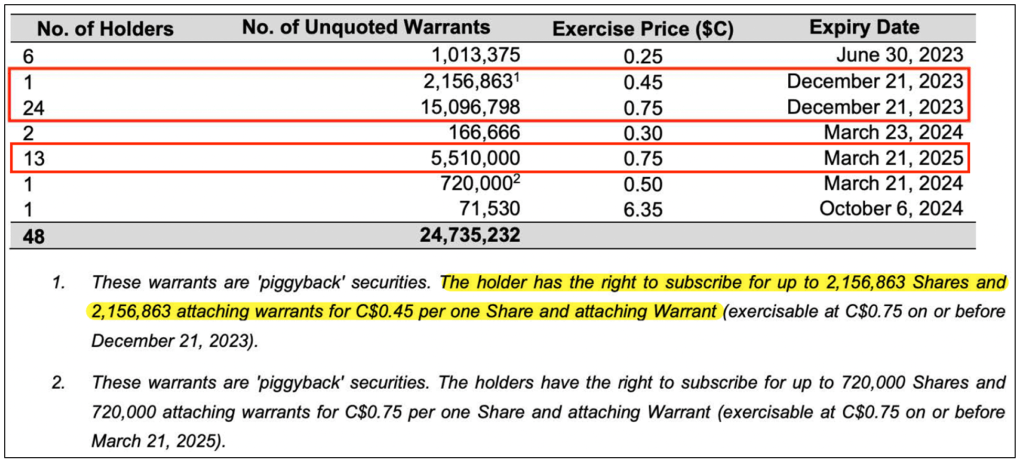

- Massive selling pressure lurks: Lock-up restrictions on shares and warrants amounting to ~60% of outstanding shares with roughly $700m of unrealized gains expired in March and warrants equivalent to $280m in stock expiring by year end.

- Patriot’s “unicorn” valuation implies they thread multiple needles: resource viability, expedient permitting, attractive financing (estimated $750m-$1bn in construction CapEx) all while lithium prices remain attractive into the next decade.

- Even on Street estimates, we see 30%+ downside on an EV/LCE basis considering time to production. If we are correct that initial Corvette estimates are 40% too high, near-term downside is much lower.

Disclosure: We are short Patriot Battery Metals. Please see full disclaimer at bottom of report.

July 6, 2023 — We are short Patriot Battery Metals (TSXV: PMET) (ASX: PMT) (“the Company”), a lithium exploration “unicorn” with a reckless $2bn (all figures in CAD) fully diluted enterprise value but without an established resource. We see downside in consensus resource estimates, permitting assumptions, and a highly dilutive share structure that will pressure shares after a 70x rally since 2021.

Current shareholders are betting Patriot’s Corvette property hosts economically mineable lithium comparable in size to the world’s largest hard rock spodumene projects. Patriot’s loquacious CEO has instigated the speculation, repeatedly guiding towards a viable resource in excess of 100m tonnes (Mt) grading above 1% lithium oxide (Li2O) and sell-side analysts have substantiated the hype with an average “conceptual resource” forecast of ~125Mt at a grade of 1.2% Li2O. For context, there are less than ten hardrock lithium projects globally with resources above 100Mt of at least 1% grade [IGO Limited, Pg. 4].

Based on our analysis of drilling data we estimate a current resource below 100Mt (even with generous assumptions), over 40% below figures recently touted by Patriot’s CEO.

Resource speculation has flourished under Patriot’s opaque disclosures. The Company hasn’t published a geological cross section since June 2022, claiming such industry standard disclosure is ambiguous. We find this reasoning suspect considering the CEO has encouraged 100Mt+ speculation for at least a year. Shrewd investors should consider the possibility that cross section modeling points to a resource below expectations.

Announcement of the initial resource has been repeatedly delayed – originally targeted for the Fall of 2022, latest guidance is late July 2023. We think investor expectations of a 100Mt number ran past what was supported by drilling data, forcing Patriot to delay a maiden estimate while it continued to drill.

Complicating matters was the unlocking of 55m shares and warrants ~$700m in the money (almost 60% of outstanding shares) beginning in December 2022, most of it owned by investors whom the CEO has said he knows personally. A resource announcement below consensus would make it difficult to monetize these shares and warrants, 90% of which remain unexercised.

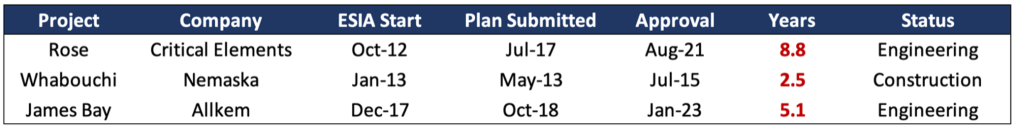

We also believe guidance and consensus is overly bullish with respect to Patriot’s timeline to production. While management and sell-side analysts think Corvette could be producing lithium in under 5 years, we think a more realistic timeline is 7-10+ years, considering the tendency for delays in new lithium projects and permitting that could be relatively burdensome since Corvette is in an ecologically and culturally sensitive region of Quebec, much of it under water.

Multiple suspect and curiously timed buyout rumors have surfaced. The first was reported in January, weeks after 20m shares and warrants were unlocked. The latest, written by a reporter infamous for publishing false M&A rumors, quoted a market cap off by 70%. Yet Patriot chose to respond to the obviously false report within 2 hours, bringing more attention to it in effect.

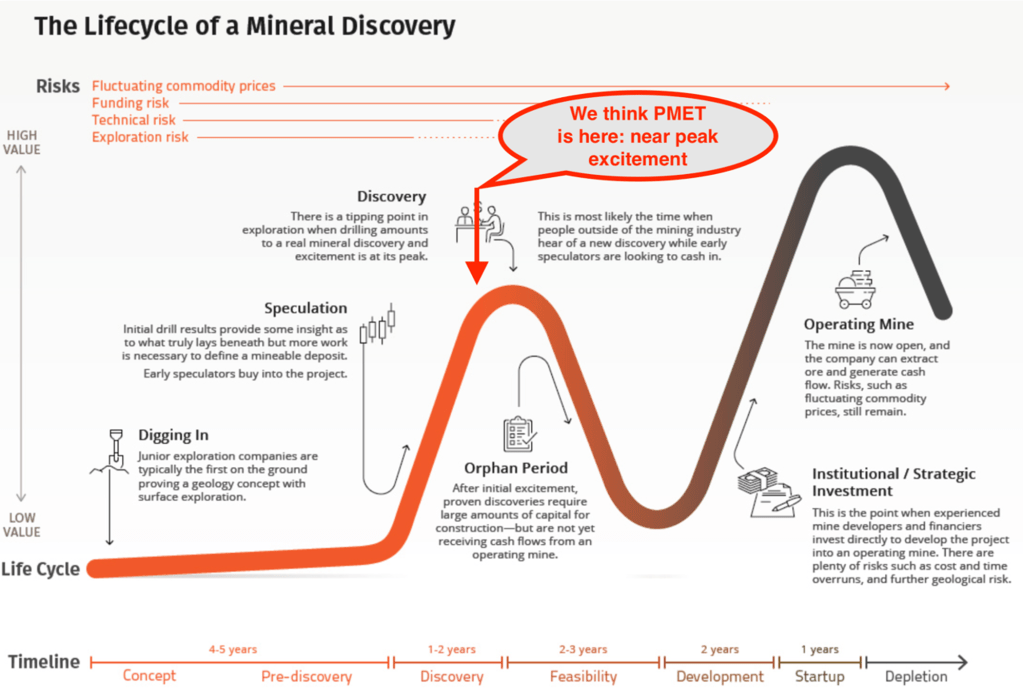

With the highly anticipated resource estimate approaching, we think Patriot is near a speculative peak. Afterwards attention will likely shift to relatively prosaic matters like costs, permitting, softening lithium prices, the wall of unexercised $0.75 warrants, and the financing of a capital-intensive project that has in large part led to the bankruptcy or restructuring of other once promising miners (see Nemaska and Non-Executive Chairman Ken Brinsden’s own Atlas Iron). We think the stock is at risk of a painful correction.

Bull Case: Patriot Owns Promising Lithium Resource

Patriot owns the Corvette Lithium Project located in James Bay, Quebec. The Company has identified a lithium trend on the property with multiple pegmatite outcrops over 50 km of strike length. Drilling thus far has focused on the “CV5” pegmatite, with an initial mineral resource estimate targeted for late July.

In one-on-one investor conversations and interviews, management said it expects an initial CV5 resource of at least 100Mt with upside potential from outcrops yet to be drilled extensively. Sell-side estimates of Corvette’s size range from 90-160Mt graded between 1.1% to 1.3% of Li2O or 2.7-4.4Mt lithium carbonate equivalent (LCE).

Multiple Pivots and Heavily Promoted by an Obscure Entity Associated with Psychedelic Mushrooms Out of a Suburban House

Incorporated in 2007, Patriot was originally focused on gold exploration doing business as Rio Grande Mining. Rio Grande changed its name to 92 Resources in 2014, later acquiring several properties in the Northwest Territories exploring for base and precious metals.

In September 2017, 92 Resources acquired initial exploration rights to Corvette, paying $45k in cash and 1.5m warrants priced at $0.15 [Pg. 2]. In 2019, PMET acquired additional claims next to the original properties from Osisko Mining (TSX: OSK) for $2.3m in exploration expenditures and 2m shares.

In October 2019, 92 Resources changed its name to Gaia Metals which changed its name to Patriot Battery Metals in June 2021. In February 2022, Patriot acquired the remaining 50% interest in Corvette (taking ownership to 100%) from O3 Mining (TSXV: OIII) for $3m in cash and 1.8m shares issued at $0.64 [Pg. 12], implying an $8m valuation for the property. O3 Mining sold its Patriot stake in September 2022 (an O3 executive told us they thought PMET’s valuation at the time was “crazy” so they exited) [Pg. 19].

We spoke to a sector expert familiar with O3’s sale to Patriot:

“The valuations in lithium projects are insane, they didn’t have a resource, they only have holes… if you factor CapEx into all of this you don’t even get into a $200m valuation max! If you get any expert to look at the engineering… you probably get less…”

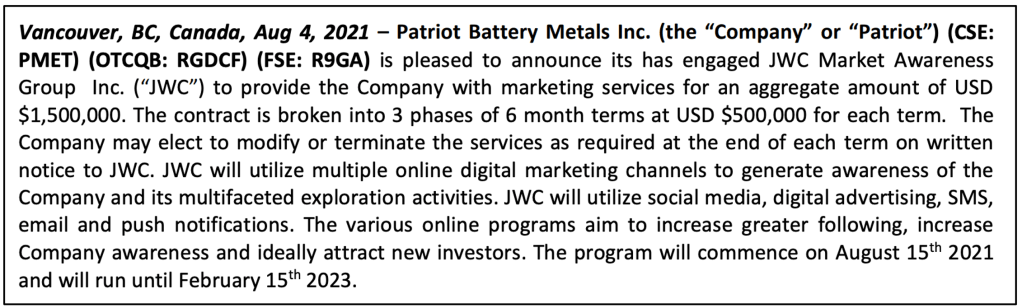

Under the name Patriot Battery Metals, the Company has employed stock promotion from marketers including Red Cloud Financial Services, Proactive Investors, Resource Stock Digest, and an entity known as JWC Market Awareness Group. Patriot’s engagement of JWC was particularly aggressive: between August 2021 and January 2022, Patriot paid JWC $1m.

Paid Interview with Proactive Investors

Patriot Engages Obscure Entity in $1.5m Stock Promotion Agreement

Junior mining companies commonly utilize stock promotion, but we find the size of Patriot’s deal with JWC unusual, especially since the Company reported only $3m in cash the previous quarter. JWC seems to have been formed solely for Patriot – it was incorporated five weeks before the engagement and we were unable to find evidence of JWC having any other clients. An email sent to JWC was unreturned. JWC corporate records list Jeffrey Chen as director. JWC’s corporate address is a house in Vancouver:

We were able to confirm Chen’s involvement in two entities outside of JWC: Core One Labs (CSE: COOL), (f/k/a Lifestyle Delivery Systems), a Vancouver-based “psychedelic medicine” company valued at $22m, and Isracann Biosciences (CSE: IPOT), (f/k/a) Atlas Cloud Enterprises and Atlas Chain Blockchain Group), a $2m Israeli cannabis firm (incidentally shares in both Core and Isracann are down 99% since the time Chen is found in filings). We found no information regarding Chen’s experience in stock promotion.

CEO Associated with Poor Shareholder Returns

While we acknowledge that failure is common in junior mining, considering Patriot’s run to a multi-billion-dollar EV at such an early stage, we think it’s worth highlighting the poor stock performance of companies associated with CEO Blair Way.

CEO Blair Way was an insider in at least seven junior miners since 2008. On average the shares of these companies are down 69%.

It’s also worth mentioning that most of the companies Way held senior roles in are currently nanocaps. Again, we acknowledge that past performance doesn’t guarantee future returns, but keep it on your radar.

Premium Embedded in Patriot for Ken Brinsden’s Involvement, But Macro Can Sink It Similar to Atlas Iron

Patriot shares rose 35% in two trading days after Ken Brinsden was appointed Non-Executive Chairman in August 2022. Brinsden was previously Managing Director and CEO of Pilbara Minerals, owner of the Pilgangoora mine, one of the largest spodumene projects in the world. Pilbara is an impressive success story and Brinsden managed it effectively.

However, as noted above failure is commonplace in the mining industry, with its high CapEx requirements and sensitivity to macroeconomic factors, and Brinsden is not immune. Before joining Pilbara, he was Managing Director and Non-Executive Director of Atlas Iron. During a period of surging iron ore prices, Atlas was regarded as an “emerging iron ore powerhouse” hitting a peak A$2bn valuation in 2011. Falling iron prices squeezed debt-heavy Atlas, forcing it to conduct heavily dilutive capital raises and equity for debt swaps. Lenders called for voluntary administration in 2015 and Brinsden left shortly afterwards. Atlas was acquired for A$280m in 2018, it’s stock down 90% from peak.

We think Atlas serves as a cautionary tale for Patriot investors who may be involved at least in part for Brinsden’s association. Sector risk and falling commodity prices can sink even the most promising miners with effective leadership. With a $2bn enterprise value pre-resource potentially a decade from production, it’s not unreasonable to consider a similar fate for Patriot.

Elevated Risk in Maiden Resource Announcement After CEO Aggressively Promotes 100Mt+ Figures

While stock promotion and Ken Brinsden’s hiring have contributed to interest in Patriot, its valuation is primarily supported by resource expectations which have been largely shaped by published drilling results and comments from Patriot CEO Blair Way. Way has aggressively promoted the potential of Corvette, hinting at a “triple digit” resource as early as a March 2022 interview when Patriot only had assays from 4 drill holes at CV5.

Resource Stock Digest: “From my biased opinion it doesn’t seem like a far stretch to say that if you’re able to put out a resource estimate here in 2022 you could be showing the market the potential for triple digit tonnage and by triple digits meaning you know 100m tonnes plus. Is that out of the realm of possibility?”

CEO Blair Way: “I have to be careful when answer a question like that but certainly the scale of what we’re looking at even between CV1 and CV5 there is the potential for something of that scale without a doubt. The drill still has to deliver that and certainly what we’re seeing is sending us in that direction.”

Way has done multiple interviews with Resource Stock Digest (Patriot pays RSD a “sponsorship fee”) in which he and the host who is also a shareholder speculate about a 100Mt+ resource. For example, in July 2022 Way told RSD, “…as [Patriot] approaches triple digit numbers that suddenly becomes very meaningful for some of these bigger players in the lithium space.” In a September interview with Red Cloud (whom Patriot also pays for stock promotion), Way laid out CV5 dimensions equal to a 130Mt resource [30:00]:

“We haven’t got an official resource so I have to be a little careful what I say but with a 2.1 km corridor or even around 100 m thick and 300 m deep you can do the math relatively easy on that even taking some compromises for natural pinching and swelling of a pegmatite body, but it appears to be well and truly in the triple digits…”

The speculation became more aggressive in December 2022, when the RSD host opined a 200Mt CV5 maiden resource wouldn’t be surprising with no resistance from Way.

The aggressive guidance has helped propel the stock, but it’s also backed Patriot into a corner, in our view, especially as shares and warrants equal to 60% of outstanding stock (mostly owned by investors whom the CEO knowns personally [10:00]) would free from lock-up restrictions beginning in December 2022. When owners of these shares and warrants look to exit, PMET shares will be pressured whatever the resource estimate.

We think a large mismatch in expectations compared to what drilling data supports, combined with the looming cliff of unlocking shares explains why the initial estimate has been continually delayed. In June 2022, Patriot said it would disclose an estimate in the Fall. In December Patriot pushed the release to the first half of 2023 and recently to late July.

Last month Way upped guidance further during an interview with MiningStock Daily. Comparing the valuation of Patriot to Australian miners in order to show that PMET is relatively cheap, he said Patriot believes it has a resource exceeding Liontown (ASX: LTR), an Australia-based emerging lithium producer whose two projects total 171Mt [Pg. 3].

“[Liontown] has a $5bn CAD offer… from Albemarle… Now if you compare the scale of what Liontown has compared to what we have, we believe we have more than that.”

It wouldn’t surprise us if Patriot delayed a CV5 resource again.

Limited Cross Section Disclosure Increases Resource Estimate Uncertainty: Why Hide?

In combination with management comments, Patriot’s uniquely poor disclosures have likely allowed the “triple digit” resource forecasts to proliferate. In June 2022, Patriot stopped

publishing cross sections in its drilling assays press releases, against established industry best practices. CEO Blair Way defended the lack of disclosure in a recent interview:

“I got pretty slick at being able to explain why we’re not putting sections out is because it’s basically, it’s a pegmatite-intrusive body, and the majority of sections that are I see put out by some of our peers or whatever you wish to call them, I feel are misleading. So, we don’t want to go down that path. Once you put a section in, it becomes a… It has to be a cartoon section. It can’t be one that’s drawn off the scientific model because the way a scientific model in the lack of data, it pinches out. That’s not correct. It’s just how the model works. So, if we put out a section that shows everything pinching out below our last hole, people are going to misinterpret it in a negative way.

Alternatively, we can draw a nice stick figure or cartoon section, and it implies it could be swelling at depth, which is what you can say. Either way would be misleading. So, in the absence of being able to provide… If the information will be provided to professional geologists who look at sections as part of their career and understand the true meaning of that section, then we’re happy to put it out…

Igneous intrusive bodies can pinch and swell and move around. And until we drill this thing out until we can provide a number that goes along with those sections which will tell people what the resource is, that’s the time that we can share that data, and we’ll feel comfortable that it’s not going to be either misleading in the positive or misleading in the negative. So, in the absence of being able to do that, we’re just not putting sections in. People don’t like it. I get it…”

Way admits he is willing to show professional geologists cross section interpretations, but not investors as he believes the latter will misinterpret models showing mineralization pinching away from intercepts. We find this view concerning – investors deserve industry standard transparency to better understand the shape, orientation, and size of a resource – and at odds with Way’s promotion of a “triple digit resource” as well as his very direct comments on PMET’s valuation.

In addition to the highlight drill intercepts Patriot reports, the Company’s geologists have surface maps with pegmatite outcrops, multi-element assay results for all sampled intervals, visual logs of lithology in drill core, and 3D models with a good indication of the geometry and estimated true widths of mineralized zones that can be illustrated on cross sections. (We note that while Patriot is not disclosing this information, external geologists will incorporate the data when establishing an initial resource.) We suspect CV5 cross sections would disappoint market expectations of Corvette’s size.

For more context on the lack of CV5 cross sections and the elevated risk associated with Patriot’s mineral resource estimate, we suggest investors review three discussions on PMET from the well-informed Money of Mine podcast team.

Patriot’s Drilling May Overstate True Widths, Inflating Resource Size Expectations

Note: We worked with a mining sector analyst to help us interpret PMET’s drilling results. The analyst is a licensed Professional Engineer with senior operational mining experience.

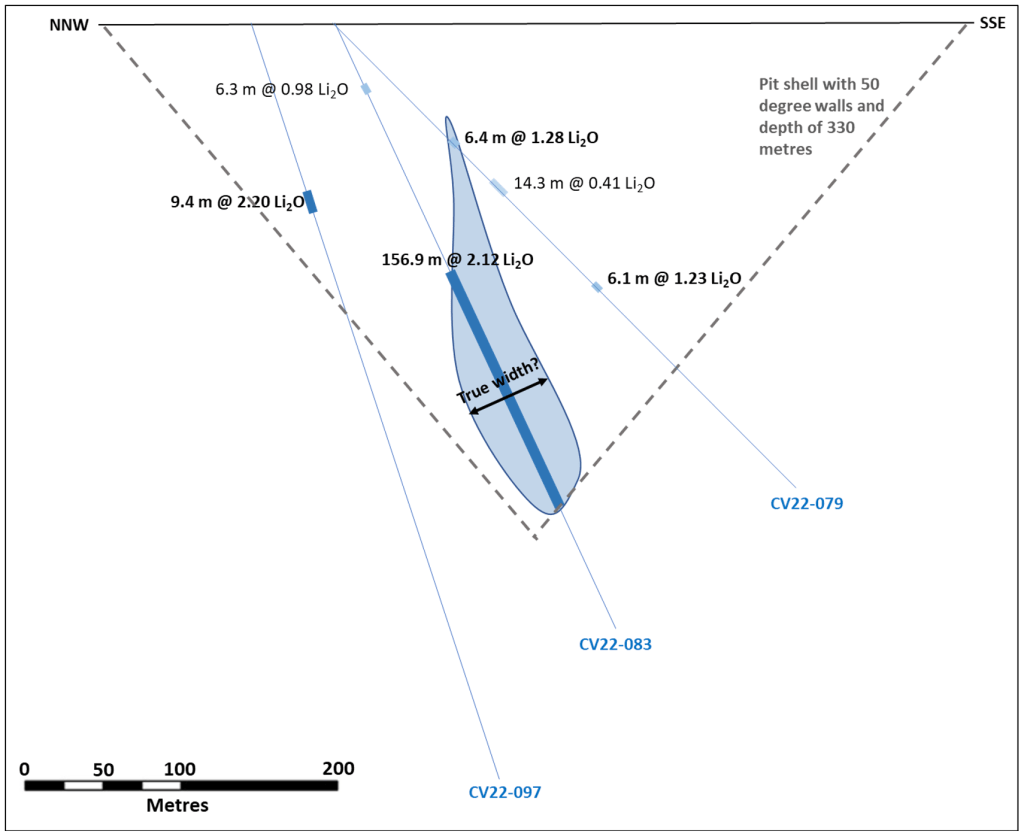

To illustrate the issues that arise when evaluating drill results without cross sections, we hypothesized cross sections for three Corvette drill holes: CV22-079, CV22-083, and CV22-097. Assuming near-vertical structures, which coincides with Company commentary, we think true thicknesses of highlight intercepts could be less than half of what is being reported.

Illustrative cross section with drill holes CV22-079, CV22-083, and CV22-097

One of the most impressive holes at Corvette is CV22-083 which was drilled at -65° and returned an impressive 157 m 2.12% Li2O intercept (Patriot’s 2021-22 campaign data can be found here). However, CV22-083 may overstate the true width of the mineralization if the structure is steeply oriented – for example 60 to 70 m wide would be a lot less impressive than 157 m. Also, the intercept from CV22-079, drilled from the same platform but at -45°, was only 14.3 m grading 0.41% Li2O. If the structure is steeply dipping this likely means the high grade in CV22-083 does not extend very far upward.

Deep hole CV22-097, likely drilled to test if the high grade seen in CV22-083 extends below at depth, may also be disappointing as it failed to show vertical continuity.

Of the 137 holes at CV5 with reported assays, 39 were drilled steeper than 50°. If the mineralized bodies are near-vertical, drilling should be done at -45° so reported widths are not misleading.

Drilling Details and Lack of Cross Sections Raise Questions About Highly Touted “Nova Zone”

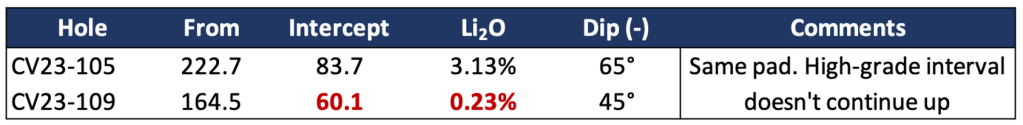

We see similar issues in the first assays announced from Patriot’s 2023 program targeting the so-called “Nova Zone”, an area at CV5 which the Company is touting for higher grades.

CV23-105 is a -65° hole with an excellent intercept of 83.7 m at 3.13%. However, CV23-109 was drilled from the same pad at -45° but only hit 60.1 m at 0.23%, indicating the high-grade interval in CV23-105 doesn’t continue upwards or it would have been intersected downhole in CV23-109. Or perhaps the mineralization is not vertically oriented.

Either way the implications are negative. Pegmatites tend to sit on top of granitic intrusions, and this may be what PMET is targeting. If so, the vertical continuity of mineralization is limited, and it’s unlikely the mineralization extends from the surface to these reported intercepts ~200 m underground.

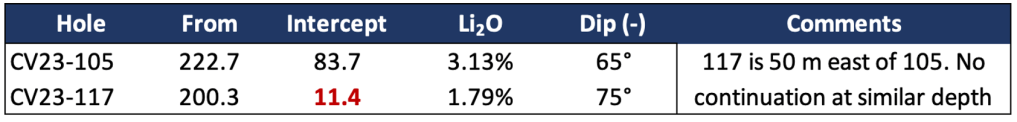

Moreover, variability between the reported 2023 program holes is high. CV23-117 was drilled at -75° and is 50 m east of hole CV23-105, so we should expect it to hit the continuation of the impression intercept in CV23-105 at similar depths but it only hit 11.4 m of 1.79%, which suggests the mineralization could be quite skinny.

CV23-110 was drilled 50 m east of CV23-109 and both are -45° holes. Yet CV23-110 hit much better grades (85 m at 1.04%) than CV23-109 (60.1 m at 0.23%). This may indicate the higher-grade zone intersected by CV23-105 suddenly turn shallower or that it’s very thin and hole CV23-117 missed it because it was too steep. Again, we would know more about the shape and orientation of the structure if Patriot was publishing cross sections.

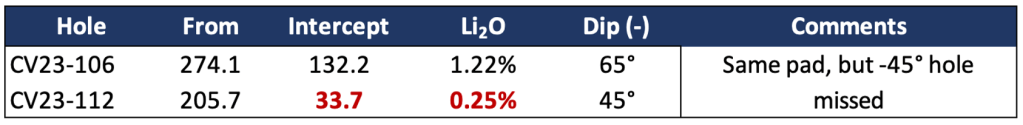

Lack of consistency is also seen in CV23-106, a -65° hole that hit a nice intercept (132.2 m of 1.22%) yet the accompanying -45° hole CV23-112 failed to intersect much mineralization. Same for CV23-107 and CV23-111, which are from a pad 100 m to the east.

We also note the high-grade mineralization at Corvette looks to be relatively deep. The -65° holes appear to be hitting nice mineralization in most cases, but the -45° holes are not, suggesting a lack of continuity of the high-grade mineralization upward from the reported intercepts. This does not bode well for an open pit mine due to potentially significant pre-stripping and waste removal to access the high-grade ore body.

NMR’s Mineral Resource Estimate: Over 50% Below Figure Touted By CEO

There is no doubt that Corvette is a significant lithium discovery. PMET has delivered solid drill results over a strike length that is now at least 3.7 km (including recent drilling with core still in labs). However, we think consensus estimates are too high: the average sell-side estimate is 125Mt graded at 1.10% Li2O, and retail promoters are predicting over 200Mt [18:00].

Using disclosed drilling data and generous assumptions, we calculate a “back of the envelope” estimate for Corvette of 73Mt at 1.28%.

We used a simple volumetric analysis (available here):

- Length – Strike length of 3,700 m based on step-out drilling, giving Patriot credit for 0.9 km of recently announced drilling that intersected spodumene-bearing pegmatite but for which assays have yet to be reported.

- Thickness – Indications from PMET and the drill results suggest the main pegmatite is vertical or near vertical. Thus, the dip of the drill holes can be used to estimate true widths. Taking reported drill hole data at 100 m spacing, including the best reported holes, gives us a calculated average true width of 48 m.

- Depth – A big unknown because in most cases there is only one drill hole piercing the main pegmatite per section, leaving uncertainty about how far Li2O mineralization extends vertically in the main pegmatite body. Based on intercepts reported in some of the steeper angled drill holes, we assumed this is 194 m – generous given the lack of drilling on section and the lack of cross-sections provided by PMET.

Based on these assumptions, a volumetric calculation for an ellipsoidal ore body, and converting that volume to mass with expected specific gravity for Quebec pegmatite of approximately 2.7 we get 73Mt at an average grade of 1.28% Li2O. (If we assume a rectangular ore body – unrealistic in our view – we get 93Mt at the same grade.)

CV5 Highlight drill intercepts

Permitting and Regulatory Process: Corvette is Under a Lake, Lengthy Delays Common – Potentially 10 Years Until Production

Considering the enormous run in the stock to large extent based on resource speculation, it’s important to remember how early Patriot is in development and the propensity for longer than expected timelines to production. After Patriot establishes a resource, extensive processes lay ahead including:

- Pre-Feasibility Study

- Definitive/Bankable Feasibility Study

- Environmental Impact Studies

- Preliminary Development Agreement

- Impact Benefit Agreement

- Federal and Provincial permitting

In a November 2022 investor presentation, to support the idea that near-term supply will come in below forecasts Allkem (AKE:ASX) shared a Canaccord Genuity table explaining that lithium projects are “always late”. The hard rock projects highlighted by Canaccord achieved steady state operations 3 to 6 years later planned.

Industry analysts often tout how attractive Quebec is for mining companies, citing the Fraser Institute survey which ranks jurisdictions based on geology and government policy. But despite its 6th place ranking, the province has produced few success stories in lithium.

Noted industry analyst Joe Lowry believes lithium supply will remain constrained, even though multiple projects are emerging in Canada. “Quebec likes to tout they have a great educated workforce and their low hydro cost, but Quebec’s been trying to produce lithium for 15 years and only this year will you reopen a mine [NAL] and it’s going to be relatively small,” Lowry said at an industry conference in April.

“There was an FT article this week that basically framed it the way Canaccord says it now … lithium projects are three years late on average. I think it’s a little worse than that.”

Contributing to the lack of lithium mining success in Quebec is relatively demanding permitting requirements. The finance manager of Sayona Mining (ASX:SYA) which owns a stake in NAL, said that while the provincial government is supportive of new lithium producers, the permitting involved is extensive.

“Canada is a very good jurisdiction, Quebec is very supportive of the development of resources there, but certainly I think developing greenfield projects is a challenge, particularly with permitting”, Sayona’s Dougal Elder told Stockhead.

“The permitting is quite extensive in Canada, compared to say other jurisdictions (like) Western Australia.”

In addition to provincial and federal permitting, Patriot will have to negotiate with the indigenous Cree population as part of the Environmental and Social Impact Assessment (ESIA) process which is mandated for all proposed development projects in the region.

In investor presentations, Patriot compares Corvette with several James Bay projects. Note that for two of them the ESIA process took over 5 years to complete. Allkem’s James Bay received federal ESIA approval in January, over five years after submitting its preliminary project description to the Canadian Environmental Assessment Agency. Allkem has still not begun mine construction as provincial and construction permitting [Pg. 18] remain in process.

Much of the high mineralization area at Corvette is underwater requiring drainage and damming which will involve additional permitting. And the lakes in the area may contain an endangered species of fish known as the Lake Sturgeon, which may further complicate permitting.

Patriot’s latest investor presentation shows completion of federal and provincial permitting by the end of 2025 [Pg. 15]. Sell-side analysts publishing timelines predict Patriot reaches spodumene production as soon as 2028. However, considering the ecological sensitivity of James Bay and the tendency for delays in new mining projects, plus assuming two years for mine construction, we think such timelines are optimistic by several years making Corvette a 2032+ production mine.

Implausible Buyout Rumors from Suspect Australian Sources Coincidental with Share Unlocks

In February, The West Australian reported a rumor that Mineral Resources (ASX:MIN) was buying Patriot shares on the open market. The paper pointed to recent strength in the stock and Mineral Resources buying a 9.6% stake in Global Lithium (ASX:GL1) last year. GL1 has an enterprise value of roughly $300m and an established resource base of 50Mt at 1.0% Li2O, a bargain all else equal relative to Patriot. It’s hard for us to believe MIN or any other institution would buy a large stake in PMET at its current valuation before the Company has done even the minimal de-risking by establishing a resource.

Rumors that Pilbara (1, 2) is considering Patriot as an M&A target have circulated since January. Pilbara’s CEO Dale Henderson denied they were considering an acquisition or stake in Patriot, pointing out that while the asset has potential, the Company is very early stage.

“My assessment from a long way away is, gee it looks like there could be some potential in that asset, but [Patriot] are early in their journey. There is a lot required to bring an asset to life.”

The latest potential buyout rumor surfaced in an article in The Australian written by a mining reporter so infamous for false, error-filled reports of takeovers that the Financial Review said her “back catalogue of epic blunders could fill the Library of Congress.” The report on Patriot was no different, underquoting the Company’s market capitalization by 70% and claiming the stock was cut in half this year while it’s near all-time highs.

Even though a report containing such basic errors is obviously false, Patriot went so far as to issue a denial in a press release . We find it odd that a $2bn mining company would pre-emptively issue a denial (within 2 hours) to an amateurish and objectively incorrect report, effectively bringing more attention to it, only weeks before its supposedly publishing its maiden resource estimate.

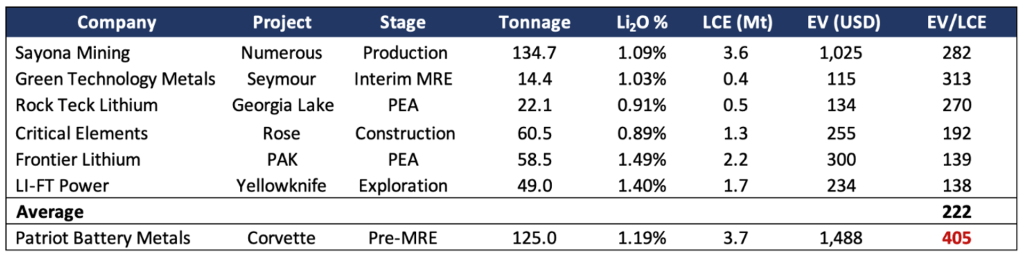

Valuation: Trades Significantly Above Developers Closer to Production

Comparing Patriot to other pre-production (or just started production in Sayona’s case) North American spodumene developers reveals how expensive it is. Using the 3.7Mt LCE average analyst estimate for Corvette, Patriot trades at the highest EV/LCE multiple of the group despite being second furthest from production.

Sources: Critical Elements [Pg. 32], Green Technology Metals [Pg. 4], Sayona Mining [Pg. 11], Li-FT Power [Pg. 15], Rock Teck [Pg. 9], Frontier Lithium [Pg. 2]

All but one of the above peers has published a resource estimate – Li-FT Power is set to begin drilling in Q2, but trades at a significant discount likely because it’s resource expectations are based on a surface study from the 1970’s.

Considering its higher EV/LCE multiple relative to comps closer to production, it appears Patriot has more than priced in a resource above 125Mt. See Critical Elements, which is expected to begin mine construction in the near term but trades at a 50% discount to Patriot.

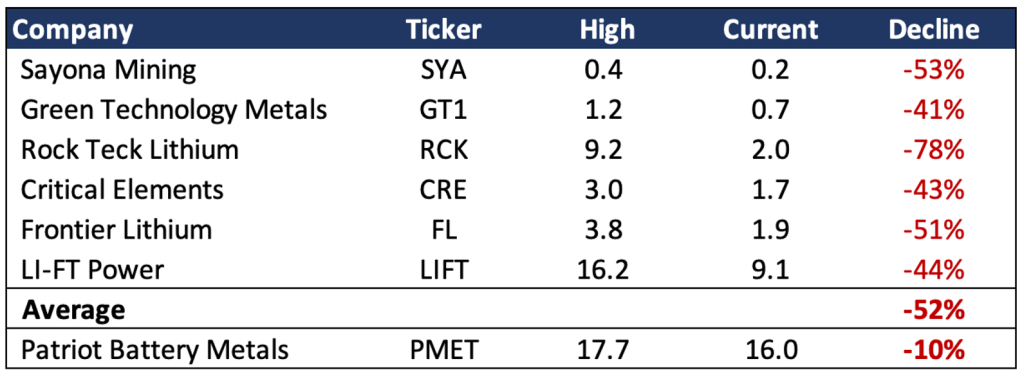

Patriot is also exceeding its peers on price performance. Lithium stocks in general have declined from peaks earlier in the year, in part due to the decline in lithium prices. Patriot is significantly outperforming when measured from peak levels to current:

Technical Overhang: Warrants and Shares Equal to 60% of Outstanding Recently Free from Lock-Up. 20m More Warrants Must Be Exercised by End of Year

Besides a relatively full valuation, near term Patriot’s stock carries the weight of 50m deep in the money stock, options, and warrants making up nearly 50% of outstanding shares. As an obscure junior miner, Patriot conducted almost two dozen capital raises 90% below current levels. Particularly concerning are offerings done in December 2021 and March 2022 for a total of 26m shares and 24m warrants (23m of which are unexercised as of June) with lock up periods that ended between December 2022 and the end of March 2023.

The owners of these units are sitting on over $700m in profit.

Owners of the outstanding warrants hold a cumulative paper gain of $360m. Note that only 25 investors hold the warrants from the December 2021 offering which expire at the end of this year.

In one-on-one conversations, CEO Blair Way has said the deal sits with Australian investors who will likely exercise warrants early to trigger the start of a one-year holding period (under Australian tax law taxable capital gains are discounted by 50% for assets owned for at least a year). However, if the stock experiences significant downside volatility in the coming months these shareholders will likely be especially quick to sell.

High Profile Shareholders Include Investor Accused of Stock Promotion and Broker Awarded 5m Shares and Warrants

The involvement of high-profile, vocal mining entrepreneurs has added to retail interest. One of the Australian shareholders involved by the beginning of 2022 was Tolga Kumova, a mining investor with a large following (a so-called finfluencer) who has been criticized for publicly promoting companies in which he has a financial interest. Critics argue his public statements inappropriately influence the investment decisions of less sophisticated investors.

Kumova gave an interview February 2022 in which he said he was buying Patriot shares. While investors who followed Kumova into PMET at the time have fared extremely well, in light of the Company’s current valuation we’d caution that buying on his recommendations has often turned out poorly in the past.

Financial Review profiled Kumova in 2017 after he made the paper’s Young Rich List. The paper noted the sharp rallies of the six companies he had invested in that year. In 2019 Financial Review revisited Kumova and the same portfolio of stocks:

“And so persuasive is Kumova that for a while there, the hottest investment strategy around was to simply buy whatever he did. The strategy has had less to recommend it of late.

Of those six stocks — Alderan Resources, New Century Resources, European Cobalt, Hill End Gold, Meteoric Resources and Draig Resources — only Draig, now known as Bellevue Gold, is above where it was in 2017. And since that profile, the remainder are down between 62.8 per cent to 98.3 per cent.

When this newspaper profiled his portfolio two years back, Kumova had the touch of Midas, having that year invested in six ASX-listed mining stocks that had surged between 110 per cent and 600 per cent that calendar year.”

Investors who are involved in PMET relying on Kumova’s advice should be aware that he’s admitted to inflating the value of a mineral resource in the past. During a hearing as part of a defamation suit Kumova brought against the individual behind Twitter personality Stock Swami who accused Kumova of engaging in “pump and dump” campaigns, Kumova admitted to inflating the value of mining claims owned by New Century Resources (ASX:NCZ) by 9x or $4.8b. At the time Kumova held a significant position in NCZ and was a member of the company’s board. NCZ shares are down 95% since Kumova’s erroneous tweet.

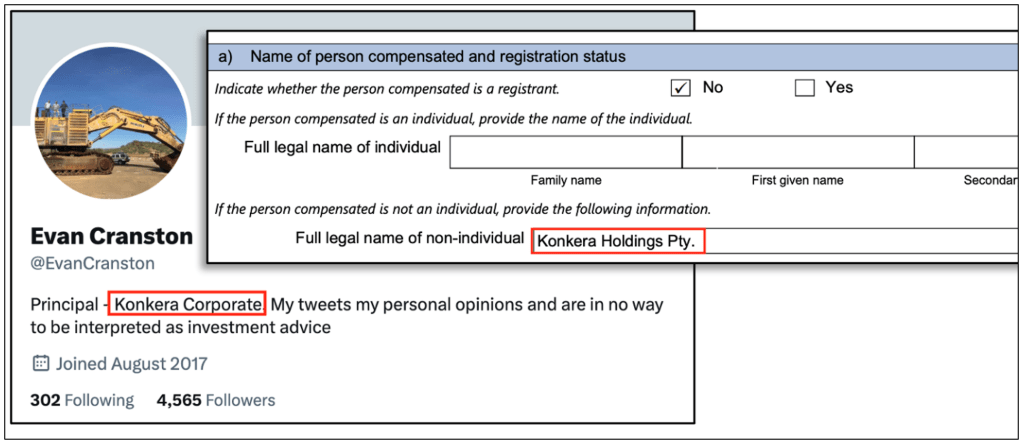

Kumova’s frequent investment partner and fellow New Century director Evan Cranston is also involved in Patriot. Cranston is a corporate lawyer who has served on the boards of multiple junior minors with Kumova. For those unaware, Cranston is the principal of Konkera Holdings Pty Ltd which served as the broker for PMET’s December 2021 offering of 18m units (one share at $0.61 and one warrant struck at $0.75). Konkera received compensation of 977k shares and 2.15m broker units (one common share and one warrant).

Cranston began promoting Patriot on Twitter in February 2022. “I’ll add this to my list of potential [unicorn] companies. Not many companies have this scale.” Cranston has tweeted frequently in support of PMET since. Although his role as broker can be discovered in filings, we do not believe Cranston has disclosed the relationship to his Twitter followers.

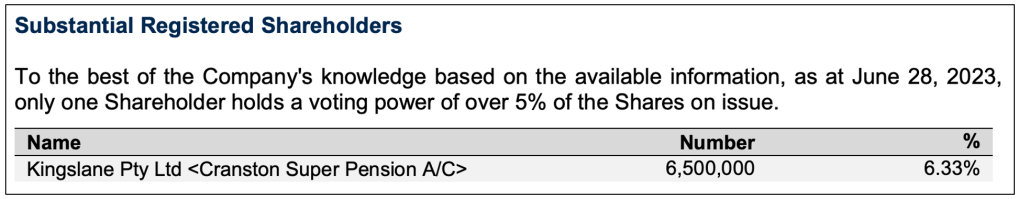

Cranston’s interest in Patriot is also via his parents, owners of Kingslane Pty Ltd, the largest registered owner of common stock with 6.5m shares.

Lithium Prices Rolling Over, Strategists See Further 50% Drop in Spodumene Prices

Chinese battery grade lithium spot prices are down ~40% from highs reached at the end of 2022. According to Goldman Sachs, the weakness is due to a period of softening EV demand and stable lithium production as emerging lepidolite projects became operational at the beginning of 2023.

Goldman strategists predict lithium will see “significant” downside in the medium term due to years of heavy mining investment and consensus expectations underestimating supply growth in China and Latin America. GS forecasts lithium carbonate prices will drop to $34k/t by year end (25% lower than current). The bank expects a market in surplus in 2024 and spodumene prices to fall by over 50%. We think the market is underpricing the commodity price risk for early-stage, pre-resource lithium explorers like Patriot.

NMR’s View: Sell the Hype

Patriot’s valuation leaves little margin of safety in a heavily promoted and volatile sector where delays and cost-overruns are pervasive. Based on our examination of PMET’s drilling data, we think consensus may be overestimating an initial resource by over 40%, putting the stock at risk for a large drawdown. However, even if Patriot reports a resource estimate on time and in-line with analyst estimates, we think the stock could pull back as investors look at a mostly inferred resource and shift focus to the long road of mundane next steps: feasibility studies, costs, permitting, engineering, and large-scale financing against the backdrop of recently soft lithium prices – re-valuing the stock more appropriately against peers closer to production.

Disclaimer

As of the publication date of this report, Night Market Research (NMR) and Connected Persons (as defined hereunder), along with or through its members, partners, affiliates, employees, clients, and investors, and/or their clients and investors have a short position in the securities covered herein (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the price of any stock covered herein declines. NMR and NMR Connected Persons are likely to continue to transact in the securities covered herein for an indefinite period after an initial report, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in NMR’s research.

Use of NMR’s research is at your own risk. In no event shall NMR or any NMR Connected Person be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. NMR is not registered as an investment advisor in the United States, nor does NMR have similar registration in any other jurisdiction. To the best of NMR ‘s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources NMR believes to be accurate and reliable, and who are not insiders or connected persons of the issuer covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. NMR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and NMR does not undertake to update or supplement this report or any of the information contained herein.

NMR Connected Person is defined as: NMR and its affiliates and related parties, including, but not limited to any principals, officers, directors, employees, members, clients, investors, and agents. One or more NMR Connected Persons may have provided NMR with publicly available information that NMR has included in this report, following NMR’s independent due diligence.