- New revenue recognition policy materially inflates 1Q23 revenue and full year 2023 guidance but has no effect on cash flow or profitability – underlying growth and key performance metrics remain weak.

- Bull case is based on SaaS segment generating less than 20% of total revenue. SmartRent is primarily a reseller and installer of third-party devices at thin gross margins.

- Customers accounting for $105m (63%) of 2022 revenue are LPs in SmartRent’s largest investor. At end Q1 the investor no longer owns SmartRent, potentially cutting a source of incentivized demand.

- US multifamily rental industry negatively impacted by higher interest rates and expenses will challenge management’s pivot from aggressive growth to efficiency.

- Competitor describes deteriorating conditions in the multifamily market, declining volumes and ARPUs, and increasing competition in retrofit projects.

- Enterprise value ~14x current SaaS ARR is mis-priced considering inadequate size and lackluster growth.

- Expect stock to retrace 30% post Q1 rally and resume trend lower as effects of accounting change roll off and underlying growth remains subpar.

Disclosure: We are short SmartRent. Please see full disclaimer at bottom of report.

June 27, 2023 — We are short shares of SmartRent (NYSE:SMRT), an “enterprise real estate technology” company selling smart home devices and building management software in the multifamily rental market. Although management advertises a “software platform” model, SmartRent is primarily a reseller of third-party hardware with nearly flat gross margins. We think SmartRent stock is expensive in general due to poor economics and lukewarm growth, but the 30% rally on what appears to be a misunderstood 1Q23 revenue and earnings beat puts the stock at near-term risk.

SmartRent remains sub-scale almost two years after its August 2021 de-SPAC which marketed 2022 revenue and EBITDA targets that were missed by 50% and 260% respectively. The stock is down 70% since the transaction but the current valuation ($700m market cap, $500m enterprise value) remains unsupportable, in our view. Less than 20% of SmartRent’s sales are SaaS-based with the balance in thin-margin hardware sales and money losing installation services. After a broad retrenchment in proptech, management has pivoted from a growth-centric strategy to focus on efficiency, but we think it’s unlikely SmartRent can adequately accelerate its SaaS segment while sufficiently cutting expenses.

SmartRent’s largest institutional investors aren’t waiting to find out. RET Ventures and Bain Capital were early SmartRent investors who combined owned over 33% of shares at de-SPAC. Both have completely exited as of 1Q23, a concerning signal from sophisticated investors deeply familiar with the company. Moreover, RET’s exit may negatively affect demand dynamics from SmartRent’s largest customers – many of the largest multifamily rental owners are limited partners in RET Ventures, incentivizing them to purchase SmartRent products.

Meanwhile a tightening macro backdrop of higher interest rates and expenses is pressuring the multifamily rental industry. Rising debt payments and increasing property taxes and insurance costs are contributing to declining property values making smart home amenity installations harder to justify.

Optimistically assuming sequential SaaS growth similar to 1Q23 (as hinted on the earnings call), the stock is trading at ~13x ARR exiting 2023, expensive considering it’s mediocre growth profile off of a tiny sub-scale base.

Revenue Recognition Change Superficially Inflates 2023 Revenue Growth

SmartRent reported first quarter revenue of $65m and an EBITDA loss of ($8.5m) relative to consensus of $56m and ($10.5m) respectively. The better-than-expected results sent the stock up 30%. However, a revenue recognition change pinned to a minor product update explained most of the growth and hid stagnation in SmartRent’s underlying business.

SmartRent reports three business lines:

- Hardware

- Professional Services

- Hosted Services

Hardware until 1Q23 included resales of third-party smart home devices such as Ring cameras, Honeywell thermostats, and Yale locks. First quarter gross margin improved to 13% from 1% in the same quarter last year.

Professional Services includes revenue from the installation of smart home devices. Gross margin in 1Q23 improved to (38%) from (120%) in 1Q22.

Hosted Services includes the SaaS business – subscription revenue for SmartRent’s software applications. This segment also includes SmartHubs, central connection devices manufactured by SmartRent which tie together the third-party hardware. Gross margin was 62% in the first quarter vs 29% in the same quarter last year.

Before 1Q23, SmartRent primarily sold SmartHubs which require the company’s software to function. Revenue for these “non-distinct” hubs is deferred and amortized on a straight-line basis over an estimated life of four years.

In late December 2022, SmartRent began exclusively selling hubs with a temperature control function. Revenue for these “distinct” hubs is recorded in the Hardware segment in full upon device shipment. The effect is a significant acceleration in revenue and an improvement in Hardware margins (SmartHubs have higher margins than third-party devices).

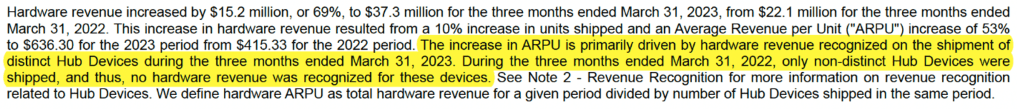

How much additional revenue is attributable to the change in revenue recognition?

Additional revenue attributable to the accounting change can be calculated by multiplying hub shipments by price and adjusting for hub revenue that would have previously been amortized.

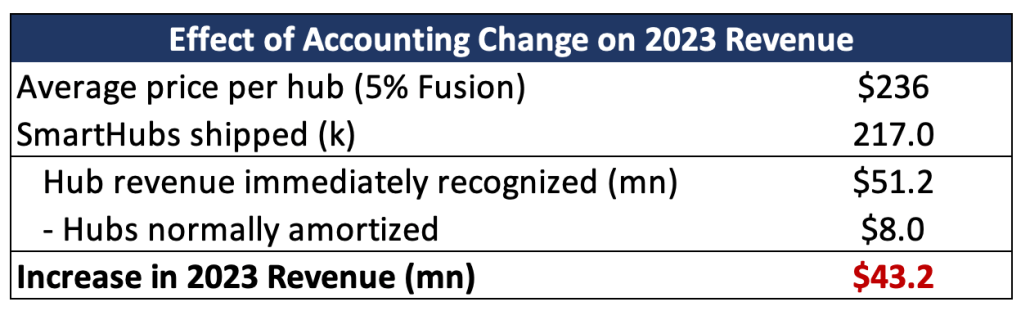

In the 10-Q, SmartRent noted the $15.2m or 69% increase in hardware revenue was due to a 10% increase in volumes and a 53% increase in average revenue per unit (ARPU) to $636, the latter “primarily driven by hardware revenue recognized on the shipment of distinct Hub devices.”

According to management, standard distinct hubs sell for between $200-250 and new premium Fusion hubs, introduced late last year, range from $450-500. Assuming only 5% of hubs sold in the quarter were Fusions, and prices of $225 and $450 for standard and Fusion hubs respectively, average price per hub was $236 and Hardware ARPU without the revenue recognition change is $400.

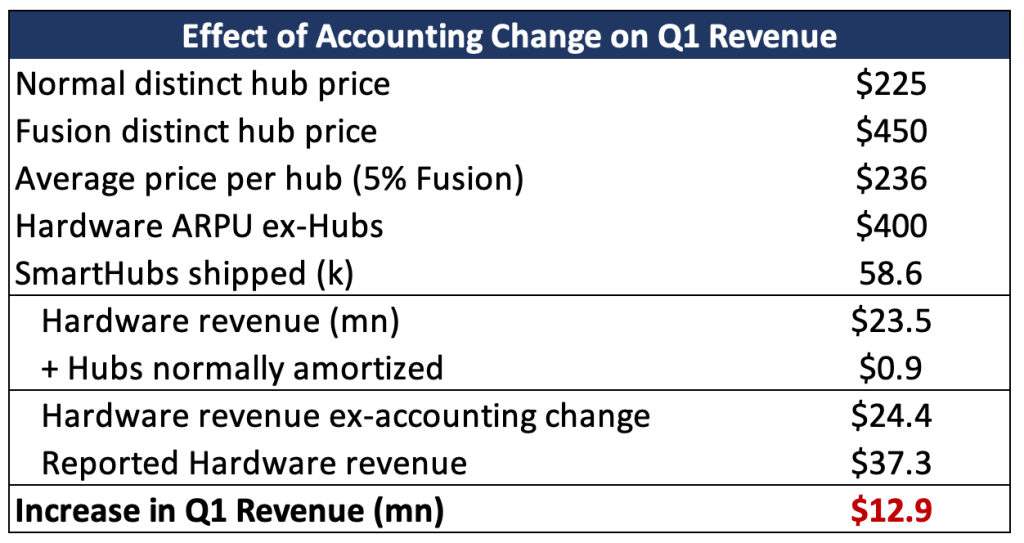

Result: We estimate the new revenue recognition policy inflated 1Q23 revenue by approximately $13m. Assuming hub growth doubles to 8% in 2023, we estimate the impact on full year revenue will be approximately $43m.

The accelerated revenue recognition has no effect on cash. Our estimate of the reported revenue increase syncs with the $14m drop in change in deferred revenue on the cashflow statement between 1Q23 and 1Q22.

Reality: Growth Weak and Key Operating Metrics Plateauing

Looking through the superficial revenue increase, actual growth is anemic. SmartRent reported sales of $168m in 2022. Management provided 2023 full-year guidance of $225-250m, or 41% growth at the midpoint. Removing $43m from guidance shows real growth of only 16% at the midpoint and 8% at the low-end. Note that revenue figures in 2024 won’t have the same artificial growth benefit.

Units booked (binding orders signed during the quarter), an indicator of future revenue, was only +1% sequentially and -29% y/y.

Based on our estimate, Hardware ARPU without the revenue recognition change declined 4%, a concerning signal at odds with SmartRent’s “land and expand” strategy. And declining ARPU in SmartRent’s largest segment will complicate management’s new focus on operating efficiency.

Also concerning is that SaaS ARPU is stagnating. After growing significantly due to the integration of property management software from SightPlan (acquired in March 2022), SaaS ARPU was only +2% sequentially and -14% vs the initial SightPlan bump in 2Q22.

The $9m in SaaS revenue was up 10% sequentially and 59% y/y (organic ex-SightPlan). Growth in the higher margin SaaS business is key to the bull case, but SmartRent’s growth is off of a tiny base – SaaS annual recurring revenue is only $36m approaching two years post de-SPAC.

SaaS gross margin (a new metric SmartRent is disclosing) improved to 73% from 70% in Q4, but again the segment remains a fraction of the business (14% in Q1).

Note that second quarter revenue was guided 20% lower sequentially and despite the first quarter beat full year guidance was unchanged. According to CFO Hiroshi Okamoto, the first quarter benefitted from a pull-forward of orders from the second quarter.

Off The Radar: Accounting Change Overlooked

We think analysts and investors have misunderstood the effect of the accounting change or overlooked it entirely. This seems at least in part due to a general apathy for the name – according to SmartRent’s website, 8 analysts provide coverage, yet only 3 published updates after first quarter earnings.

Deutsche Bank mentioned “a full quarter of new hub shipments” but didn’t quantify the effect of the revenue recognition change or the decline in underlying Hardware ARPU. The analyst at Compass Point noted “improved profitability” but did not discuss the accounting change.

A bullish Seeking Alpha article published on May 30 from the site’s most popular author (110k followers) highlighted a “brightening financial outlook” for SmartRent based in large part on the first quarter revenue beat. The author doesn’t discuss the revenue recognition change and none of the 70 comments point to accounting. SMRT rallied 10% on the day the article was published.

Largest Investor Exited as of First Quarter Removing Incentive for Largest Customers

Since the SPAC transaction, SmartRent’s largest investors have completely left the stock. RET Ventures, Bain Capital, Spark Capital, and Lennar held 45% of shares at de-SPAC [Pg. 112] but as of end 1Q23 own no shares (Lennar owns 1.8m warrants awarded as inducement to purchase SmartRent products).

At the same time that SmartRent is shifting focus to efficiency, SmartRent’s most significant investor completed its exit. Real estate technology venture capital firm RET Ventures was the earliest and largest investor in SmartRent, beginning with $1.5m of seed capital in 2018. RET owned 23% of outstanding shares at the time of the SPAC transaction.

RET began reducing its stake after the 6-month lock-up restriction expired in February 2022. By the end of 1Q23, RET had completely sold out of SmartRent.

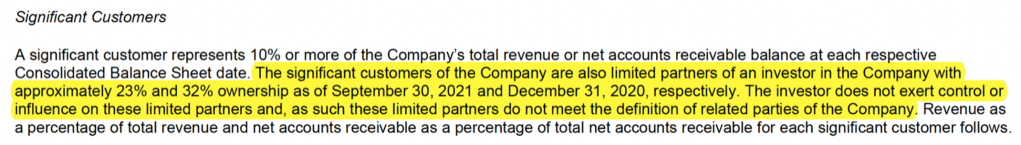

RET helped drive demand into SmartRent products. Many of the largest US multifamily rental property owners are LPs in RET and thus had an added financial incentivize to do business with SmartRent. According to SmartRent disclosures, RET “does not exert control or influence on these limited partners and, as such these limited partners do not meet the definition of related parties of the Company.”

However, RET marketing materials highlight the fund’s ability to steer its investors into portfolio companies. In an April 2022 interview, an RET principal discusses the fund’s efforts to influence the purchasing decisions of its LPs:

“We figure out similar to all of you guys in the room what are the operating problems that are facing the industry today. Then we go out and we find technology solutions to address those problems. Once we do that, we try to drive a lot of revenue to our portfolio companies from our LPs…”

The muddied incentives perhaps influenced SmartRent’s March 2022 acquisition of SightPlan, a developer of property management software. SightPlan, in which RET had a 17% stake, had $9m of recurring revenue according to RET marketing materials. SmartRent paid $135m or a 15x multiple – not cheap considering tech multiples had corrected by that time and SightPlan only contributed $11m in sales (22% growth) during the last year vs $3m in operating expenses per quarter [Pg. 40].

What’s most concerning going forward is the loss of investment-related incentive for multifamily rental owners who are RET strategic investors to purchase SmartRent systems. RET LPs accounted for $105m (63%) of 2022 revenue [Pg. 35]. In 1Q23, two RET LPs made up 29% of revenue.

RET’s exit is also a worrisome signal from the investor who is arguably most familiar with the company. RET sold the latter half of its stake between 3Q22 and 1Q23 when SMRT’s volume weighted average price was $2.55.

Multifamily Rental Market Demand Impacted by Higher Expenses

Deteriorating conditions in the multifamily market will handicap SmartRent’s attempts at profitable growth. Higher interest rates and loan payments are negatively impacting property values. Combined with higher inflation and expenses including insurance costs which are on average 26% higher vs last year, the environment is squeezing property owners, making the installation of amenities like smart home devices harder to justify.

Excessive supply is also curbing property values and owner pricing power. During Lennar’s first quarter earnings call, executive chairman Stuart Miller commented on oversupply and declining multifamily rents:

“I would note additionally that through our multifamily apartment division, we are also seeing that rental rates have moderated. Given our extensive experience in the multifamily apartment market, along with our for-sale and for-rent housing business, we see that there is general downward pressure on rents, as many markets have become somewhat overbuilt and there is additional inventory being completed and coming online.”

The suboptimal conditions will depress SmartRent volumes and already stagnating Hardware and SaaS ARPUs. We spoke to a senior sales executive at a competitor who noted increasing stringency from property owners who are narrowing purchases (buying fewer shades, light switches, and higher-end finishes) and declining ARPUs. Interestingly, they also said SmartRent used to have exclusive arrangements for retrofits with large multifamily companies, but owners are more frequently using multiple vendors.

Expect Stock to Resume Trend Lower

We believe the market has overlooked and/or mistaken the effect of a superficial accounting change as an indication that SmartRent’s underlying business has markedly improved in 2023. The easy comps (which roll-off in 2024) are artificially boosting reported revenue growth and painting over a stagnating, sub-scale business that recently lost its most important investor in a softening macro environment. We expect a correction after investors take a closer look.

Disclaimer

As of the publication date of this report, Night Market Research (NMR) and Connected Persons (as defined hereunder), along with or through its members, partners, affiliates, employees, clients, and investors, and/or their clients and investors have a short position in the securities covered herein (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the price of any stock covered herein declines. NMR and NMR Connected Persons are likely to continue to transact in the securities covered herein for an indefinite period after an initial report, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in NMR’s research.

Use of NMR’s research is at your own risk. In no event shall NMR or any NMR Connected Person be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. NMR is not registered as an investment advisor in the United States, nor does NMR have similar registration in any other jurisdiction. To the best of NMR ‘s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources NMR believes to be accurate and reliable, and who are not insiders or connected persons of the issuer covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. NMR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and NMR does not undertake to update or supplement this report or any of the information contained herein.

NMR Connected Person is defined as: NMR and its affiliates and related parties, including, but not limited to any principals, officers, directors, employees, members, clients, investors, and agents. One or more NMR Connected Persons may have provided NMR with publicly available information that NMR has included in this report, following NMR’s independent due diligence.