- USA Rare Earth (USAR) claims to be building an American rare earth supply chain via a ‘Mine-To-Magnet’ plan that includes a rare earth mine, mineral processing, and magnet manufacturing.

- USAR’s primary assets include the Round Top rare earth project in Texas and a magnet manufacturing facility in Oklahoma.

- After closing its SPAC transaction, the stock fell 50% but has since rebounded >150%. USAR now trades at a fully diluted market capitalization of $2.2B, driven largely by China related trade tensions and paid stock promotion.

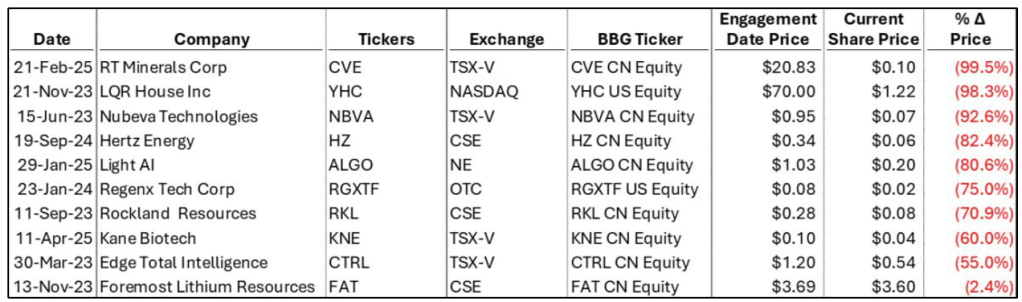

- In May 2025, USAR hired a penny stock promoter, Outside the Box Capital (OTB), for 25K USAR shares (worth ~$400K today) and $90K in cash. On August 3, 2025, OTB began a promotional barrage via third party promoters on X, Instagram and YouTube pumping USAR shares to retail investors. OTB’s track record speaks for itself with companies down an average of -71% since engagement date.

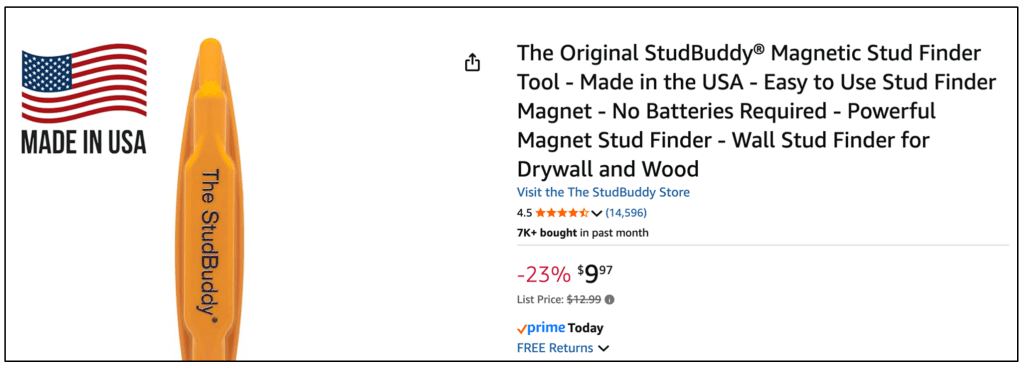

- USAR has claimed immense demand for its magnets. But based on its recent partners, we see weak commercial prospects. PolarStar is based in a house in the suburbs of Minneapolis. Another partner, StudBuddy, sells a device on Amazon for less than $10.

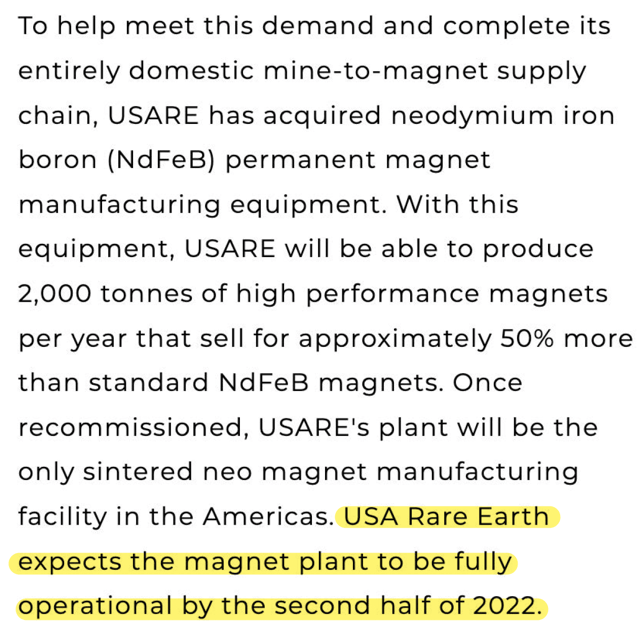

- Our research indicates that USAR’s failure to launch magnet production stems from a variety of problems, including lack of operational know-how, technical expertise, and IP rights. Since acquiring the equipment and sitting on it for 5+ years, the company has repeatedly pushed back targets.

- In 2021, then-CEO Pini Althaus promised production by late 2021, then mid-2022 and then 2023. By 2023, new CEO Tom Schneberger pushed magnet production to 2024 with Round Top feedstock coming in 2025-2026.

- Now current CEO Joshua Ballard is guiding for first production in 2026, with annual capacity by the end of that year at 1,200tpa. But even Ballard has admitted on investor calls that USAR’s manufacturing equipment, unused for ~10 years, may be outdated.

- USAR’s Round Top project has been unsuccessfully explored since the 1960s. After several ownership changes, the rights to the project ended up in the hands of a failing micro-cap, Texas Mineral Resources (TMRC).

- In 2013, TMRC conducted a Preliminary Economic Assessment (‘2013 PEA’) of Round Top, which revealed a Total Rare Earth Oxide concentration of just 0.06%.

- We spoke with a respected industry veteran who told us: “[Round Top] at 0.06% TREO content is not a resource. It’s three times the natural abundance of rare earths. You can shovel on beaches in Thailand… and you will have multiple times that content… Ridiculous to even call this a deposit.”

- Despite this, the 2013 PEA leans on egregiously optimistic assumptions – projecting that over its mine life, Round Top would be able to produce high quantities (multiples of the world’s current production) of three of the world’s rare minerals: thulium, lutetium, and ytterbium.

- In the following years, Round Top remained in stasis. In 2018, an Australian firm, Morzev Pty Limited, entered a joint venture with TMRC to advance development. This entity evolved into USA Rare Earth, with Australian mining promoter Mordechai Zev Gutnick as its mastermind.

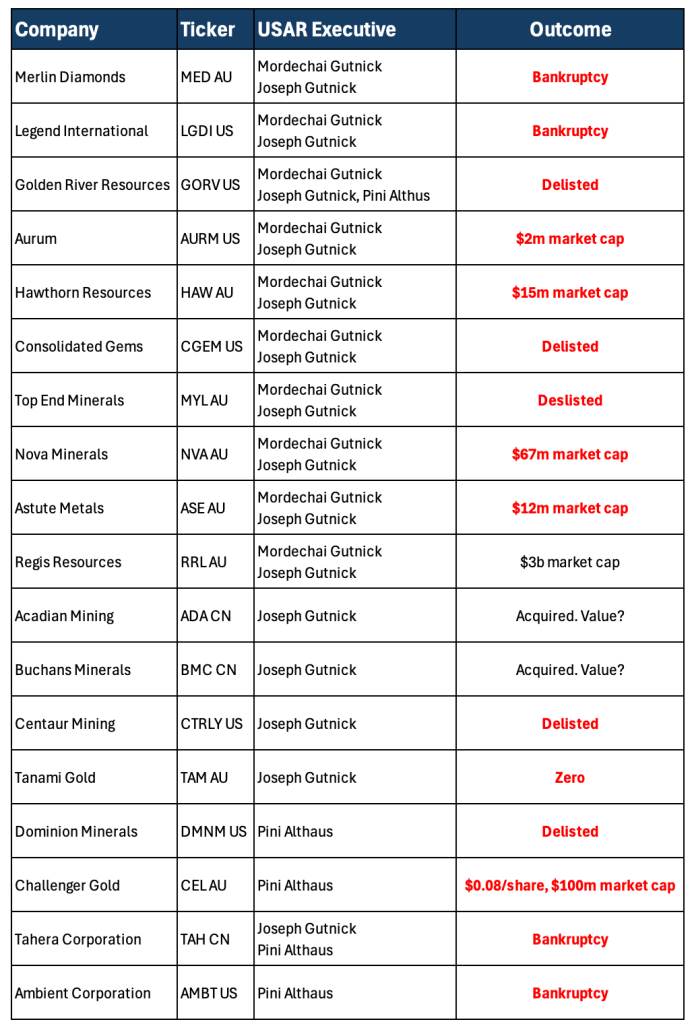

- Mordechai Gutnick still sits on USAR’s board and is currently one of its largest individual shareholders. Mordechai, along with his father Joseph “Diamond Joe” Gutnick, led numerous Australian companies into delisting or bankruptcy.

- One notable example is a loan scandal involving both Mordechai and Joseph Gutnick. In 2024, Australian regulators sanctioned Joseph banning him from holding management positions for four years.

- USAR and TMRC completed another PEA in 2019. No new holes were drilled, instead samples from old holes were examined for 16 new minerals – including lithium, beryllium and industrial minerals such as iron and aluminum. The resource estimate also revised the list of economically viable rare earths to just 7 from 15 in the 2013 PEA.

- This revision slashed Round Top’s TREO further to just 0.03%.

- The 2019 PEA also relies on laughable assumptions. For example, it assumes that Round Top would be able to consistently produce ~9,000 tons of Lithium Carbonate a year, over 2x the average production of the US’ longest operating mine .

- Silver Peak, the only Lithium Carbonate producing mine in the US, has yielded an annual average of 3,500 to 4,000 tons/year.

- Perhaps realizing that Round Top was a “Round Flop”, USAR pivoted to magnet manufacturing. In 2020, the company purchased production machinery from Hitachi Metals. We believe the equipment lacks the proprietary software needed to operate.

- Our expert told us that the production equipment USAR bought from Hitachi was useless: “It is scrap metal. By this time, it is also outdated. I think it had been operating since 2013. And this equipment they have is the end processing. You cut, you form into shape, you coat, and then you magnetize. Where is the vacuum oven? You know? Where is all the sintering”

- Josh Maslin, the CEO of Vulcan Elements, a private magnet manufacturer recently made comments stating, “We don’t buy a magnet making piece of equipment off of a shelf and start pumping out magnets… it’s not something that you can just turn on instantly… This is not easy to do, this is not buy a piece of equipment, press a button and make a magnet.”

- Despite a US government push to re-shore RE magnet production, USAR was notably absent from a July Meeting with trade advisor Peter Navarro that included 10 other rare earth companies. We emailed USAR investors relations asking if the Company attended the meeting but have yet to receive a response.

- On July 21, USAR filed a 424B3 prospectus registering ~115M shares for resale, including nearly 44M in-the-money warrants and Series A conversions (excluding earn-outs). Holders from the May 2025 raise are already sitting on a quick double from their $7.50 entry.

- The filing also registered ~29.3M shares held by pre-SPAC USAR members that are now eligible for sale after lockups expire in September.

- On August 13, SPAC sponsor executive Michael Blitzer converted 1.16M Series A preferred shares into 2.09M common shares and sold them in the open market at $15.75, cashing out ~$35M.

Disclosure: We are short USAR. Please see full disclaimer at bottom of report.

August 19, 2025 — We’re short USA Rare Earth (NASDAQ: USAR) (“the Company”), an Oklahoma-based rare earth metals company that went public via SPAC in March. USAR is attempting to develop a vertically integrated rare earth magnet supply chain, including a rare earth deposit in Texas and a magnet manufacturing facility located in Oklahoma.

We believe USAR will fail at both ends of its lofty “mine-to-magnet” strategy. We don’t think USAR will ever successfully mine its Round Top rare earth project, an area that has been unsuccessfully explored by multiple companies since the late 1960s.

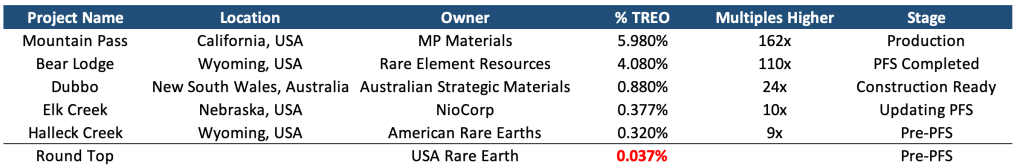

Round Top’s total rare oxide (TREO) content is just 0.06%, which is 1/100th of the only operating rare earth mine in the US, MP Material’s Mountain Pass, and only 3x the natural occurrence of rare earth elements in the Earth’s crust.

USAR was founded by Mordechai Gutnick, an Australian entrepreneur who with his father has been involved in multiple mining companies that have gone bankrupt or been delisted In 2024, Mordechai was also involved in a loan scandal at an Australian company that led to his father being barred by the Australian Securities Regulator from holding management positions.

In 2018, USAR was founded as a vehicle to acquire interest and operate the Round Top project. Two years later they acquired used and idle magnet manufacturing equipment from Hitachi Metals, pivoting focus to the magnet production after realizing, we suspect, that Round Top was a “Round Flop” as some experts have called it and to instead ride government support for rare earth magnet production.

We think USAR lacks the necessary technology, expertise, and intellectual property rights to successfully run what would be only the second rare earth magnet manufacturing facility in the US (behind MP). Moreover, we were told by an industry expert familiar with the Hitachi auction that the equipment lacks the software needed to operate.

Following its acquisition of magnet manufacturing equipment from Hitachi in 2020, USAR has:

- Failed to meaningfully progress the Round Top project.

- Failed to make significant progress on a mineral processing and extraction plant.

- Failed to begin magnet manufacturing, with repeated delays despite guiding for production years ago.

Round Top or “Round Flop”? – Decades of Failure

USAR’s vertically integrated rare earth magnet supply chain is predicated on the Round Top mining project. Located in Texas, the area comprising the Round Top project has been explored for decades – yet never successfully developed. In the 1970s, several uranium companies identified radiation associated with beryllium-fluorite deposits. In the 1980s, Cabot Corporation explored Round Top for beryllium. In 1987, Cyprus Metals took over exploration and completed a feasibility study in 1988. Cyprus eventually abandoned the project, returning the lease to the Texas General Land Office.

After Cyrpus’ departure the area was unexplored until 2007 when Texas Mineral Resources Corp (OTC: TMRC) acquired mining rights. Formerly known as Standard Silver and focused on silver exploration, TMRC purchased prospecting permits at Round Top to explore for rare earth elements, uranium, and beryllium. In 2010, TMRC obtained a 19-year lease for the roughly 900 acres encompassing Round Top mountain for a mere $142k [Pg.8].

TMRC completed a Preliminary Economic Assessment in 2012 (a revised version was published in 2013). Progress stalled, and in 2014 facing financial difficulty and unable to attract funding, TMRC pivoted to a “staged growth” plan with a scaled down processing plant proposal to lower initial and operating capital needs.

In 2015, TMRC signed a uranium offtake agreement with UG USA, a subsidiary of French nuclear power company Areva. TMRC was to supply UG with 300k pounds of uranium per year (Areva became insolvent in 2016). Also in 2015, TMRC formed a joint venture with K-Technologies to develop rare earth element extraction technology. This too stalled, with TMRC admitting in August 2018 that due to inactivity at Round Top, its interest in the JV was written down to zero.

In 2017, TMRC announced an MOU with an undisclosed investor group in which TMRC would sell 49% of the Round Top project for only $6m. The deal included a 180 due diligence period, which passed without an investment.

Round Top 2013 PEA Relies on Half-Baked Assumptions

We found the assumptions used in TMRC’s 2013 PEA, completed by Gustavson Associates, completely unrealistic including pricing assumptions, which one expert who we spoke to called “moon prices.”

To calculate a resource estimate, the PEA used an extremely low cutoff grade of 428 ppm Yttrium equivalent [Pg.3]. A cutoff grade is the minimum concentration of target minerals in an ore deposit considered economically viable.

Based on the resource estimate, TREO content at Round Top is only 0.063%, significantly lower than grades typically seen in operating rare earth mines. Note that the natural occurrence of rare earth elements in the earth’s crust is roughly 0.022%, meaning Round Top has only 3x the rare earth content of random ore.

Despite its negligible TREO, Round Top’s NPV was estimated at $1.43B, a value driven by wholly unrealistic projections that assume the project will consistently produce high quantities of some of the world’s scarcest minerals.

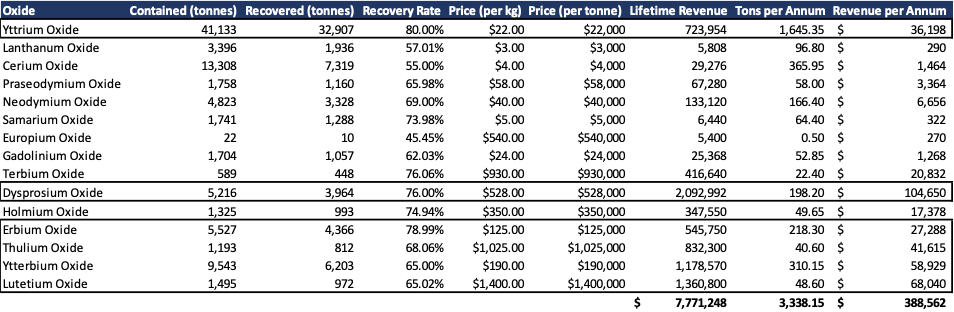

Round Top Economics Heavily Reliant on Revenue From Ytterbium, Thulium, and Lutetium

Based on the PEA’s pricing and production assumptions, we calculated the implied revenue for each mineral, over the mineral’s life (our calculation has a 0.08% difference vs. the gross revenue in the PEA, likely due to rounding). Approximately $3.3B or 43% of Round Top’s lifetime revenue is derived from just three heavy rare earth elements – Ytterbium, Thulium and Lutetium – which according to the PEA are “little used” but critical to the economics of Round Top.

To describe the potential uses of these HREEs and to substantiate their significance in the economic projections, the PEA quotes a 2013 JP Morgan rare earth report:

Ytterbium: “Very few rare earth ores contain appreciable concentrations of ytterbium. Notable among these, are locations in Malaysia and Canada, as well as the Chinese REE bearing laterites. Chinese laterites produce, essentially, all ytterbium used in the world today (about 50 metric tons), though other deposits are richer in this scarce REE, and could potentially produce larger quantities.” [Pg 117]

The 2013 PEA acknowledged that only 50 tons of Ytterbium is used globally per year (global production is at that level today), yet the NPV calculation assumed ~310 tons of production per year. Assuming there would be a market for 6x global consumption, it would likely crush the $190K ton price used in the model.

Thulium: “It is the rarest of the rare earth elements. Thulium is found only in very small quantities (up to 1/2 of 1% of oxides) in some rare earth ores. Like promethium, thulium is currently so rare that it has little influence on supply/demand dynamics in the world of rare earth element mining, distribution, or in the manufacturing of end-use products.” [Pg 116]

Round Top’s PEA assumes ~40 tons of production per annum, which would likely collapse the $1M/ton price used in the model.

Lutetium: “Lutetium is astoundingly scarce, even in the richest REE ores. It ranges from 0% to 1% of recoverable metal in most ores, but most commonly represents 0.1% or less. World production is only around 10 metric tons per year, and the prices of the metal and its oxides are correspondingly high.” [Pg 117]

For lutetium the model assumed Round Top could produce almost 5x the global supply at the time or 48 tons of lutetium per year, which would likely obliterate the assumed price of $1.4M/ton if there’s even demand for that amount of the metal. Shanghai Metals Market, currently quotes Lutetium at ~$715K/ton.

To illustrate how much the project’s economics hinge on these three elements, we ran a sensitivity analysis. A 30% reduction in revenue from these elements pulls the NPV of the project below $1B. A larger drop- of more than 50% drives down the NPV below $700M and the IRR below ~43%

Minor adjustments in the PEA’s treatment of three exceedingly scarce rare earths with highly illiquid markets result in significant declines to Round Top’s economics.

It’s also noteworthy that, other than the 2013 and 2019 PEAs for Round Top, we were unable to find another public rare earth PEA completed by Gustavson Associates, .

In reality, we think the PEA assumptions were force fed to generate a superficially attractive NPV. There’s a reason why established mining companies like Cabot (NYSE: CBT) explored Round Top and abandoned it.

USA Rare Earth’s Beginnings: Despite The Name, Conceived By Australian Stock Promoter Mordechai Gutnick + Associates

With a stretched PEA based on far-fetched assumptions and a minute TREO content, Round Top would become part of a new focus for USAR – a vertically integrated “mine-to-magnet” strategy. The change in narrative appears the work of an Australian stock promoter and his affiliates.

In 2018, TMRC entered a joint venture agreement with Morzev Pty Ltd., dba USA Rare Earth (USARE). Despite the name, USARE was the creation of Australian mining entrepreneur Mordechai Zev Gutnick, who continues to be a director of USAR. At the time of writing, Mordechai Gutnick is the largest individual holder of common stock (after SPAC sponsor Michael Blitzer and Bayshore Capital, a PE Firm) with 13,671,026 shares, currently worth ~$220m.

In 2019, according to plaintiffs in Ramco Asset Management, LLC, et al. v. USA Rare Earth, LLC, Gutnick transferred the assets and liabilities of Morzev to a US-based entity to expand access to US based capital for Round Top. The US-based entity was registered as a Delaware LLC by co-founder Pini Althaus. Althaus served as USARE’s initial CEO from May 2019 until August 2023 and is also the CEO of Cove Capital which provided investment banking services for the transaction with TMRC.

Mordechai Gutnick is directly tied to a striking number of mining ventures that have gone bankrupt, failed or have been delisted. Pini Althaus held senior positions in several of these firms alongside Gutnick.

Mordechai Gutnick also held senior positions in several failed entities involving his father, Joseph “Diamond Joe” Gutnick, a notorious Australian mining executive who orchestrated an ugly loan scheme where Mordechai was directly involved.

Gutnick Sr led a private entity called AXIS, which ostensibly provided administrative and geological services to public companies he managed, including a company named Merlin Diamonds. In 2019, Gutnick Sr. was investigated by the Australian Securities and Investments Commission for inappropriately approving loans to AXIS totaling A$18m from listed companies he controlled. Mordechai was a director/senior executive at AXIS, and at the public companies that provided the loans.

After AXIS couldn’t repay the loans, the firms controlled by Joseph and Mordechai wrote them off as impaired debt yet raised more capital and approved additional loans to AXIS. Merlin entered bankruptcy in 2016.

In 2016, Joseph filed one of the largest bankruptcies in Australian history with $275m in debt, precipitated by a failed deal with an Indian fertilizer company.

An investigation by the Sunday Morning Herald found that money lent to AXIS was funneled to entities controlled by the Gutnick family.

“Unlike the Merlin Diamonds board, or the stock exchange regulator, The Age and SMH have been able to access some of AXIS’s confidential financial information. It shows that AXIS has operated as a conduit for the transfer of huge sums of money from public companies controlled by Mr. Gutnick to other businesses strongly linked to his family.”

As a result of the ASIC investigation, in 2024 Joseph Gutnick received a 4-year ban from managing corporations.

Under Morzev aka USARE, Round Top Remains Hopeless. Revamped PEA Uses Similarly Far-Fetched Assumptions.

Under the 2018 agreement with TMRC, USARE would spend $10m to fund completion of element separation and purification processes and a bankable feasibility study (BFS) in turn earning a 70% interest in Round Top with an $3m option for another 10%. As initial consideration for the agreement, USARE paid $140k for 646k shares of TMRC. [F-16]

In 2019, the companies entered into an amended agreement with the same financial terms but removed the BFS as a precondition to transferring 70% interest (USAR completed the $10m funding and exercised the option officially earning 80% ownership in Round Top in 2021).

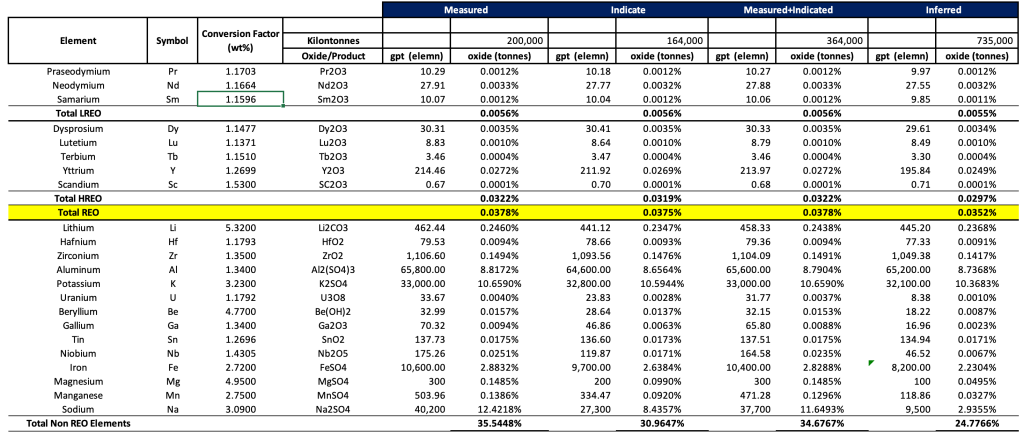

In 2019, USARE and TMRC announced an expansion of the 2013 PEA with an updated resource estimate that added 16 elements – including lithium, beryllium and industrial minerals such as iron and aluminum. The 2019 PEA did not include any recent drilling. Rather, TMRC reanalyzed 157 samples from 34 drill holes with whole rock analysis”. [Pg. 78]

Of the 15 rare earth elements modeled in the 2013 PEA model, only 7 remain in the 2019 PEA [Pg. 91].

Below is the resource estimate from the 2019 PEA expressed as % oxide/product content.

After the removal of several rare earths, the 2019 TREO dropped to only 0.037% from what was already a minuscule 0.063% in the 2013 PEA.

The only rare earth mine currently operating in the US is MP Materials’ Mountain Pass. According to this SEC Technical Report from February 2025, MP Materials has Proven/Probable TREO of ~5.98%.

Round Top’s TREO is microscopic compared with MP and several other rare earth projects currently in development:

We spoke with a renowned rare earth industry expert with over 30 years of international experience as a senior executive in mining and manufacturing. The expert was emphatic in their skepticism of USAR’s vertically integrated magnet supply chain plan.

First, the expert told us they believed Round Top was hopeless due to its minute rare earth content:

“The resource at 0.06% TREO content is not a resource. It’s three times natural abundance of rare earths. You can shovel on beaches in Vietnam, in India, in Thailand, and you can shovel some sand in Brazil, and you will have multiple times that content. It’s ridiculous.”

“Top professionals have been exploring Round Top for more than half a century, top professionals, and they turned their backs on it. And now these up starts tell you, ‘Oh, there’s great riches in Round Top.’ I mean, just look at the history Cabot Corporation. They looked at it and said it’s crap.”

“[With Round Top’s low grade, USAR] will have to mine approximately 5 million tons per year, you know, and will have depleted Round Top in 6 years if they want to produce terbium and dysprosium. The cost alone will be hilarious, and it’s technically not possible to mine 5 million tons per year. And on top of that you don’t cherry pick. You take all Lanthanides together, and you have to separate all of them, or you separate none. That is how things work.”

We asked the expert if they considered a hard cutoff grade for rare earth mines:

“I begin getting interested at a grade of about 2% TREO and a minimum content of 200,000 tons of TREO, that’s when I start getting interested.”

Although Mountain Pass is operating today, it took decades of exploration, billions in capex, and a bankruptcy. Rare earth mining at Mountain Pass began in the 1950s and passed through multiple large scale mining companies before landing with Molycorp which filed for bankruptcy in 2016 with an accumulated deficit of $1.9B and debt of $1.8B.

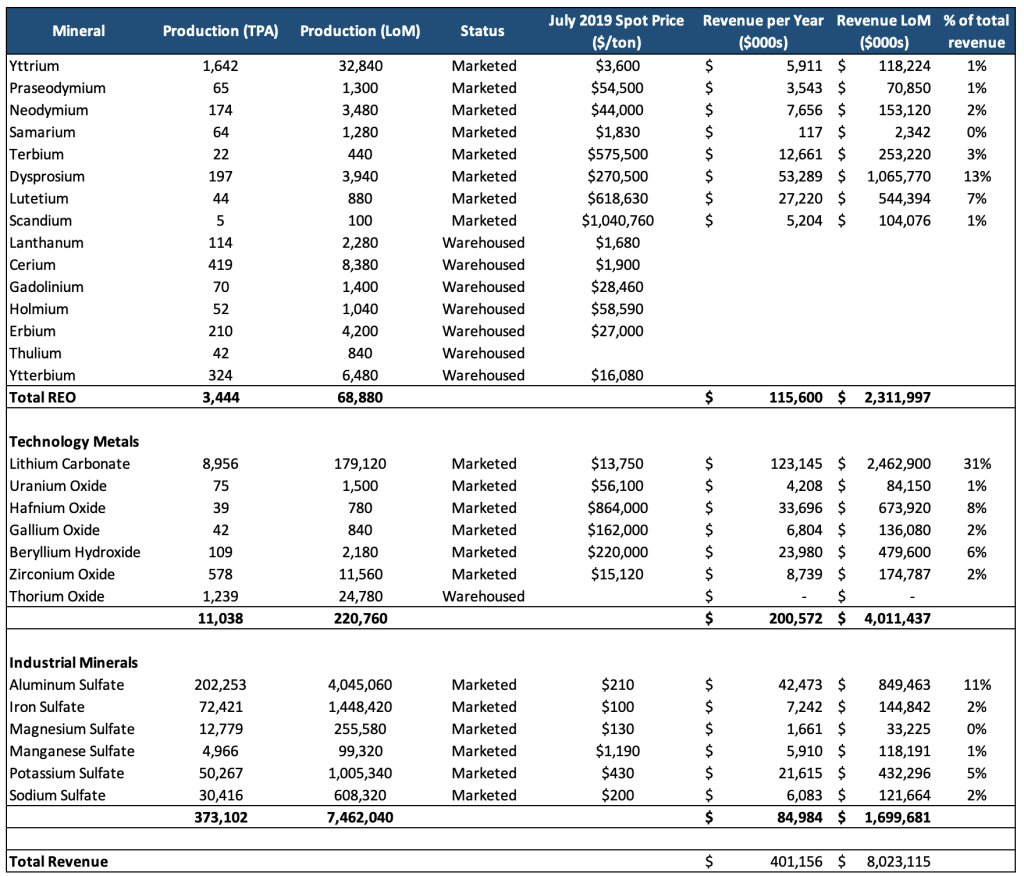

Like the 2013 PEA, the 2019 PEA uses wildly optimistic assumptions to manufacture attractive economics. Based on the prices disclosed and production forecast for each mineral, revenue on an annual basis and Life-of-Mine basis is ~$400M, excluding revenue from warehoused minerals.

Lithium accounts for about 31% of revenue, followed by Dysprosium at 13% and Aluminum Sulfate at 11%. These three minerals account for >50% with REOs only driving about 29% of revenue, which is surprising for a rare earths project.

We find the production assumptions of certain minerals in the 2019 PEA far-fetched.

The 2019 PEA assumes Round Top will produce 109 tpa of Beryllium Hydroxide. As per the USGS Mineral Commodity Summaries from 2025, US consumption has ranged between 144 to 196 tons between 2020 and 2024. Global production is roughly 325 tons for all forms of beryllium.

The 2019 PEA projects beryllium production of 109 tons per year or 1/3 of the world’s production. The added supply would likely crash the assumed price – similar to the wildly unrealistic production and price assumptions made in the 2013 PEA regarding ytterbium, thulium, and lutetium. Recall Cabot tried looking for beryllium at Round Top and passed.

The assumptions involving Hafnium suffer from similar issues. This research piece estimates that hafnium production could grow to ~180 tons by 2030 but currently global supply of pure hafnium material is only 70-75 tons a year concentrated in France, the US, China and Russia. In the US, hafnium metal is produced from zirconium chemical intermediates by two producers. Considering Round Top’s history and TREO, to assume the project can economically mine and produce 40 tons per year of hafnium – half of the world’s current capacity – is unrealistic in our view.

The US currently only has one large scale producer of Lithium Carbonate – the Silver Peak Mine owned by Albermarle, which has been operating since 1965. The mine has yielded an annual average of 3,500 to 4,000 tons/year of lithium carbonate. Albemarle has been actively pursuing an expansion strategy to boost its production to approximately 7,500 t/y by 2025. According the company’s most recent estimates, the resource can support about 30 years of additional production [from 2025]. USAR’s production estimate of 8.9K tons of Lithium Carbonate is over 2x the average production of the US’ longest operating mine and 20% higher than Silver Peak’s targeted expanded capacity.

Heavily Touted Mineral Processing Facility, Critical To The Supply Chain Narrative Quietly Dies, No Updates Since June 2020

The company’s PEA 2019 assumed acid heap leach extraction and multi-step CIX/CIC and membrane technologies to produce various end products [Pg 161]. The extraction process was outlined in several steps: Heap Leach Circuit -> Stage 1 REE Extraction -> Lithium and Sulfate Recovery Circuit.

In December 2019, TMRC and USAR announced the start of operations at their pilot mineral processing facility in Colorado. The companies said the pilot plant would “ultimately move… to Texas and scale to full industrial capability.” USAR CEO at the time Pini Althaus said the “pilot plant is the second piece of a 100%-U.S.-based rare earth oxide supply chain…”

In May 2020, USAR said it successfully completed “Phase I bench scale testing” of its rare earth separating and processing. Althaus called it an important step to “bring Round Top project into full commercial production.”

In June 2020, according to USAR, the processing facility officially opened and was being commissioned. The initial focus was supposedly on separation of rare earths into heavy, medium and lights groups, while the final phase would be focused on separation into individual high-purity REE compounds. Later, according to the Company, the pilot plant would work on recovery of non-REEs such as “lithium, uranium, beryllium, gallium, zirconium, hafnium and aluminum” which would support upgrading the resource estimate into a reserve and a PFS.

When USAR announced a $50M funding in May 2021, management said a pilot plant and a demonstration plant would be built at the Round Top site later in 2021.

However, over the next three years, the company gave no real updates on its processing facilities.

In the 2019 PEA, significant economics were driven from the production of Lithium Carbonate, yet USAR has not provided an update regarding its ability to achieve Lithium Carbonate extraction even at pilot scale.

An S-4 from November 2024 discloses minimal details: “USARE is working to progress its preliminary feasibility study for its Round Top Project (including continuing to pursue a development of a flow sheet that would be economical), and has successfully separated several of the minerals contained at Round Top to 98%-99% oxide purity at a pilot scale”.

The “several” minerals were not specified.

Then in January 2025, almost 5 years after announcing its Colorado facility, the Company claimed the production of a sample of high-purity Dysprosium. In USAR’s Q2 earnings release, the company said it successfully extracted gallium and other heavy rare earth concentrates from Round Top. USAR has not provided an update on its lithium extraction capabilities.

The rare earth mining expert we spoke to also stressed the complexity of processing over a dozen elements:

“Round Top is not a rare earth resource. Do you want to produce lithium and rare earths from hard rocks through the same factory? I mean, just a little bit of applied university knowledge will get you there – if you want to recover all the different materials at Round Top, you will also have to have dedicated processing material for each of the resources. So, the investment amount is galactic.”

USAR Deal For Hitachi Magnet Production Equipment Lacked Necessary Software Rendering it “Scrap”

Vulcan Elements CEO: “We Don’t Go Buy Magnet Equipment… And Just Turn It On”

Perhaps realizing that Round Top was hopeless even before considering the time and capital required for mineral exploration and development of processing and extraction technology, USAR pivoted to a “mine to magnet” strategy with a heavy focus on magnet production. For reference a January 2020 presentation, mentions nothing about the company’s magnet manufacturing strategy, likely because it didn’t exist at the time, in our view. The stars aligned when Hitachi Metals was auctioning off its manufacturing equipment

In 2011, Hitachi Metals built a magnet manufacturing facility in North Carolina. After the plant was closed in 2015, the equipment sat unused until USAR purchased it in 2020 for an undisclosed price. According to USAR’s press release, the equipment “provides most of what is needed to re-establish rare earth magnet production in the U.S….”

Rumors indicate otherwise. According to respected rare earth industry publication, The Rare Earth Observer, which spoke to bidders in the equipment auction, the Hitachi equipment purchased by USAR did not include the software needed to run it. Moreover, the equipment was used to produce blanks (unfinished, uncoated magnet material), not finished or “sintered “ magnets.

“The NdFeB blanks equipment came to USA Rare Earth (Morzev) without the proprietary control software. As anyone who ever operated a metal processing facility will know, without the proprietary control software all equipment is useless. It is scrap. [TREO]”

Our expert believed the magnet production equipment USAR bought from Hitachi was useless since it didn’t include the operating software:

“By this time, it is also outdated. I think it had been operating since 2013. And this equipment that they have there is the end processing. You cut, you form into shape, you coat, and then you magnetize. Where is the vacuum oven? You know? Where is all the sintering? Hitachi Metals never did magnets from scratch in North Carolina; it was always imported blanks… I believe, and I may be totally wrong, but as far as I saw, Hitachi was taking in the blanks. So, the magnet blanks, that is like 68% iron, 32% rare earth, they got from Japan with a certain characteristic as a magnet, and they cut it to size for the customers, and coated it and magnetized it”

John Maslin, the CEO of Vulcan Elements, a private magnet manufacturer based in North Carolina which recently completed funding at a $250M valuation, made interesting comments during a manufacturing podcast:

“We don’t buy a magnet making piece of equipment off of a shelf and start pumping out magnets… it not something that you can just turn on instantly… This is not easy to do, this is not buy a piece of equipment, press a button and make a magnet.”

We wouldn’t be surprised if Maslin was directly referencing USAR and its purchase of Hitachi’s old equipment considering Vulcan is also based in North Carolina. In any case, Maslin highlights the complexity of manufacturing rare earth magnet’s for aerospace and EV use cases, each with specialized requirements.

A year after buying the Hitachi equipment, USAR reportedly explored going public through an IPO or SPAC, aiming for a $1B valuation raising $300-500m in cash to in part fund Round Top and the magnet facility. Notably, Goldman Sachs was an advisor to USAR at the time but resigned from that role in October 2024.

We asked the USAR management team if the Hitachi purchase included the software necessary to operate the equipment and if not, had the company developed its own. USAR has not responded.

USAR Likely Lacks The Intellectual Property Rights to Manufacture Rare Earth Magnets

In addition, it’s unlikely that USAR has the intellectual property rights to manufacture sintered NdFeB magnets. USAR does not own any patents related to magnet manufacturing (the Company has only one application pending for metal extraction) nor has it disclosed any IP licensing agreements. Below is USAR’s patents, trademarks, and licenses disclosure in the 2024 10-K:

“USARE has applied for a United States patent in connection with its methods for metal extraction. This patent application is currently pending. Additionally, the Company utilizes trade secret protection and non-disclosure agreements to protect its proprietary rare earth technology. USARE holds a trademark for its logo”

According to a 2020 Dept of Energy report, major manufacturers of NdFeB “magnets license the right to manufacture from Hitachi [Pg. 9].

“Historically, NdFeB magnets were independently invented in Japan (Sumitomo Special Metals Corporation) and the United States (General Motors Corporation). Japanese inventors won the rights to sintered (fully dense) NdFeB magnets and American inventors won the rights to bonded and hot pressed (in which magnet particles are dispersed in a binder) NdFeB magnets. Sumitomo Special Metals Corporation merged with Hitachi Metals, Ltd and the division at General Motors became Magnequench, which was bought by Chinese investors and relocated to China. Major manufacturers of sintered NdFeB magnets worldwide, including China and Germany, currently license the right to manufacture and sell from Hitachi.” – Critical Materials Report, Dept of Energy, 2020

MP Materials’ filings indicate they purchased IP rights in August 2023 to manufacture magnets in exchange for 436k shares (recorded at a value of $9m) and at the same time entered into a consulting agreement for which MP will pay $15m over 4 years to integrate the licensed technology and know-how into MP’s processes [Pg.10].

When we asked our industry expert for the biggest weaknesses in USAR’s magnet manufacturing plan, they mentioned a lack of technical knowledge and intellectual property:

“The lack of technical knowledge and these 1000s of patents that rest on the relevant processes. You can take one thing for granted, once one of these magnet hopefuls starts processing and producing magnets, there will be patent lawyers looking at this.”

USAR’s Magnet Plans Continually Delayed Since 2022 – This Time Won’t Be Different

A lack of technical knowledge, know-how, and intellectual property rights has likely played a part in USAR’s inability to begin magnet production despite touting the Hitachi deal from 2020. USAR has a consistent history of missing and pushing back manufacturing targets.

In 2021, then CEO Althaus issued a statement commending the Biden administration’s efforts to boost domestic RE magnet manufacturing, and said the Company planned to recommission the Hitachi equipment in 2022. A month later Althaus also told Mining News USAR would start magnet production by the end of 2021.

Later in 2021, Althaus guided for magnet production in the second half of 2022. This target was inserted into USAR’s website at the time:

At an event celebrating the opening of USAR’s magnet facility in Oklahoma, management said the Company expected to complete permitting in 2022 and initial production would begin in 2023.

In 2023, then CEO Tom Schneberger said the Company was “reconstructing” the Hitachi equipment, and the plant would be producing 1,200 tons of magnets per year in 2024. Schneberger added Round Top would begin supplying the rare earths to the magnet facility in “late 2025 or early 2026”. Schneberger reiterated these targets in another 2023 interview.

USAR’s latest guidance is for magnet production to begin early next year and to hit a nameplate annual capacity of 1,200 tons before the end of 2026. [Pg. 33]

Considering the history, and that USAR sat on the Hitachi equipment for 5 years, we expect further delays. Moreover, since the equipment has not been used since 2015 and is 10-15 years old, there’s the risk the equipment no longer works or, as our industry expert believes, is outdated. USAR’s CEO Joshua Ballard briefly discussed this risk on the Q1 2025 call:

“…while our existing equipment was only used for a brief period of time and has been well taken care of it has not been run for a number of years. To avoid any delays in shipping product next year, we are testing this equipment thoroughly with the original vendors throughout this year.”

USAR Engages Tiny, Obscure Commercial Partners Including One Based In A House On a Country Road in Minnesota

Whenever USAR begins manufacturing commercial magnets, we see risk in its volume and revenue targets. The Company’s says its 2026 target of 1,200 tons of annual capacity equates to $150-200m in revenue, implying a price of ~$160/kg.

USAR has announced several MOUs with potential magnet buyers. In April 2025, USAR announced an agreement with The StudBuddy, maker of a magnetic stud finder that sells for less than $10 on Amazon.

The press release indicates USAR will supply StudBuddy with 20 metric tons of finished magnets per year. While we don’t know the annual revenue of StudBuddy since it’s private, only 6 LinkedIn profiles are associated with the company, suggesting the operation is small. Using the average reported price of exported rare earth magnets from China of roughly $50-60k per metric ton, this deal would generate only $1-1.2m in revenue for USAR.

In May, USAR entered an MOU with PolarStar Magnetics, a manufacturer of programmable magnets based in Minnesota. Only one LinkedIn account is associated with PolarStar, the registered corporate address of which appears to be located a house literally on a country road (4571 Country Road J) in the suburbs of Minneapolis:

USAR Won’t Produce Heavy Rare Earth Magnets For Years, Calling Into Question USAR Pricing Assumptions

In June, USAR entered a third MOU with Moog Electric Motion Solutions, a manufacturer of electric motion systems. While Moog (NYSE: MOG) is a large company and a promising potential customer for USAR, Moog is only prototyping USAR’s neo-magnets for its data center products.

Moreover, according to Ballard, USAR’s initial neo-magnets will be commodity neo-magnets as they will not include heavy rare earths add-ons like dysprosium and terbium that enhance coercivity and heat resistance.

As such, we expect they won’t be priced near the $160/kg implied in the Company’s revenue guidance at nameplate capacity. This was Ballard on the Q1 2025 earnings call:

“…these initial customers that we’re working on and planning on rolling out early next year will not need heavy rare earths. These are all magnets — sintered neo magnets, but at the level where we don’t need to add heavy rare earth or grain boundary diffusion in order to support them. So, we feel pretty good as we start out where we’re sitting today, and then we’ll see how things shake out in the market on the heavy rare earth side as well along with everybody else.

“If you don’t need heavies and you’re just using the light rare earths in your typical iron and boron, I think we’re very comfortable on that feedstock as we start out for the first couple of years.”

If USAR won’t be producing heavy rare earth magnets for “the first couple of years”, it’s unclear what pricing the Company can achieve. Magnets produced for products like the $10 StudBuddy aren’t likely to be priced at a premium.

Our expert cast doubt on USAR’s plan to start with common rare earth magnets that don’t include heavy rare earths like dysprosium and terbium:

“It’s good to say we start with the commodity stuff, because for the high working temperature, we are simply not skilled enough… but you still need to be competitive. You cannot say, ‘Hey, we have a magnet Made in USA, and it costs twice as much as the magnet from China’. [Customers] will say for the time being, I’m using the aluminum nickel cobalt magnet and wait for the prices of NdFeB to come down.”

Indeed, prices for NdFeB magnets that don’t include heavy rare earth additives like dysprosium and terbium are currently priced between $20/kg to $50/kg. Adding Dy and Tb enhances coercivity which is critical for EV motors, wind turbines and aerospace applications. This may be why USAR’s only MOU with actual volumes attached is with a consumer device company.

Perhaps USAR’s focus on non-heavy rare earth magnets for the first years of production is why the Company hasn’t attracted US government funding during the Trump administration’s recent push to accelerate domestic rare earth magnet manufacturing. After the impressive MP Materials partnership with the Department of Defense, the administration held a meeting in July with rare earth related companies to communicate the administration’s goal of supporting RE initiatives with additional financial support. According to Reuters, 10 rare earth companies attended the meeting, however USAR wasn’t named. We emailed USAR investors relations asking if the Company attended the meeting but have received no response.

USAR Engages Low Rent Stock Promoters to Tout Stock to Unsuspecting Retail

In March 2025, while it was supposedly hiring personnel experienced in volume magnet manufacturing, testing the Hitachi equipment, and prototyping magnets for customers – USAR found it necessary to hire a penny stock promoter known as Outside the Box Capital (OTB). OTB, which advertises stock promotion campaigns on Stocktwits, Reddit, Discord, YouTube, Twitter/X, and Telegram, initially received 25k USAR shares (worth ~$400K today) and $90k cash in May. The founders of OTB also founded NFT Technologies (OTC: NFTFF), a failed web3 related entity that trades as close to zero as any stock we’ve ever seen. On August 3, OTB hired various promoters on X, Instagram, and YouTube to pump USAR shares to retail investors.

YouTube promotion video by Undervalued Investor paid $3k by OTB

Instagram promotion by Stocksharks paid $5k by OTB

X promotion by Mr M Trades paid $1.5k by OTB

Companies busy working to become a major part of the US push to re-shore the rare earth magnet supply chain don’t hire entities like OTB.

OTB’s track record also speaks for itself with companies down an average of -71% since engagement date.

Shares Coming To Market – Buyer Beware

On July 21, 2025, the company filed a 424B3 prospectus to register up to ~115M shares to be freely tradable. These shares originated from primary issuances including warrants which are now in the money, earn-out shares, and conversion of Series A preferred stock. Excluding earn-out shares, almost 44M shares related to warrants and Series A are now in the money.

In addition, the holders participants in the May 2025 are now sitting on a quick double from their $7.50 cost basis.

The prospectus also unlocked and registered for resale 29.3M shares of common stock held by former members of US Rare Earth.

On August 13, 2025- Inflection Point Holdings and Michael Blitzer, a Director and the SPAC sponsor converted 1,161,805 shares of Series A Preferred Stock into 2,091,849 shares. He then sold such stock in open market transactions at $15.75 which is about $35M in aggregate value

Run Don’t Walk

We think USAR’s $2B market capitalization wildly overvalues a company touting a rare earth project that, according to a renowned industry expert we spoke to, has less rare earth content than many beaches in Asia. And USAR’s magnet manufacturing plans fall apart due to multiple issues – the history of continual delays in production targets, the facility founded on used equipment that our expert calls outdated scrap metal, and the lack of intellectual property. All this before considering the track record of the Company’s original founders marked by de-listings, bankruptcies, and scandal – sober investors should be repelled.

Disclaimer

As of the publication date of this report, Night Market Research (NMR) and Connected Persons (as defined hereunder), along with or through its members, partners, affiliates, employees, clients, and investors, and/or their clients and investors have a short position in the securities covered herein (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the price of any stock covered herein declines. NMR and NMR Connected Persons are likely to continue to transact in the securities covered herein for an indefinite period after an initial report, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in NMR’s research.

Use of NMR’s research is at your own risk. In no event shall NMR or any NMR Connected Person be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. NMR is not registered as an investment advisor in the United States, nor does NMR have similar registration in any other jurisdiction. To the best of NMR ‘s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources NMR believes to be accurate and reliable, and who are not insiders or connected persons of the issuer covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. NMR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and NMR does not undertake to update or supplement this report or any of the information contained herein.

NMR Connected Person is defined as: NMR and its affiliates and related parties, including, but not limited to any principals, officers, directors, employees, members, clients, investors, and agents. One or more NMR Connected Persons may have provided NMR with publicly available information that NMR has included in this report, following NMR’s independent due diligence.